Fears about the EU’s trade, resource and technology dependences have only grown since the outbreak of the pandemic, even though US-China trade disputes and the rolling out of 5G have played a significant role, too. Some analysts have pointed to the beginning of a ‘decoupling’ of certain supply chains away from China,1 and, while evidence suggests that some ‘reshoring’ has taken place since at least 2011,2 there are debates about whether the production of certain technologies should be relocated back to Europe after decades of de-industrialisation.3 Decoupling and/or reshoring are a reaction to geopolitically risky dependences, with the fear being that certain products, technologies or raw materials will be unavailable during times of crisis or that a reliance on third-party supplies will limit political freedom. In the digital age – where data dominates – there are also concerns that dependences may lead among other things to espionage or a curtailment of personal rights and freedoms. Despite the fact that decoupling is unfeasible, save perhaps for in very specific critical technology domains, the threat perception surrounding critical supplies has given rise to a different vocabulary and EU communiques and strategies are today replete with references to ‘technological sovereignty’, ‘open strategic autonomy’ and ‘digital sovereignty’.

Yet, in conjunction with this rhetoric has come a raft of new policy initiatives. In February 2020, the European Commission released a bundle of strategies on data,4 Artificial Intelligence (AI)5 and the digital future,6 which stressed the importance of reducing technological dependences in strategic areas. This is why the Commission is to invest €8 billion in supercomputing and help leverage €20 billion per year for AI.7 In March, a new ‘Industrial Strategy for Europe’ was published that stated that critical raw materials are ‘crucial for markets such as e-mobility, batteries, renewable energies, pharmaceuticals, aerospace, defence and digital applications’.8 It will be much harder for the EU to develop supercomputers and batteries without secure supplies of raw materials. To this end, on 3 September a ‘Commission Action Plan on Critical Raw Materials’ was released along with an updated List of Critical Raw Materials9 and a foresight study10 looking at strategic technologies and dependent sectors over the 2030-2050 horizon. This bundle of initiatives has made the case for the EU to diversify resource supplies, especially in an era of digitalisation that demands increasing amounts of strategic resources found outside of the Union’s territory.

If the EU is to diversify its trade and build sovereignty in key digital technology areas, however, it cannot do so while abandoning market openness. When it comes to trade, what is called for is recalibration and not a wholesale retreat. Ideas to this effect are starting to emerge. Commission Director General for Trade Sabine Weyand has stated that trade diversification may help proliferate EU trade standards and norms on a global basis, which could have payoffs for the environment and sustainable development.11

When it comes to trade, what is called for is recalibration and not a wholesale retreat.

High Representative of the Union for Foreign Affairs and Security Policy and Vice-President of the Commission (HR/VP) Josep Borrell has even asked whether the EU could lower its dependence on China by enhancing trade relations with Africa.12 This idea is worthy of further reflection given the number of Free Trade Agreements (FTAs) and economic partnerships the EU has around the world. Yet, any trade diversification strategy needs a clearer idea of the products and sectors that should be diversified and those that should be developed within the EU.

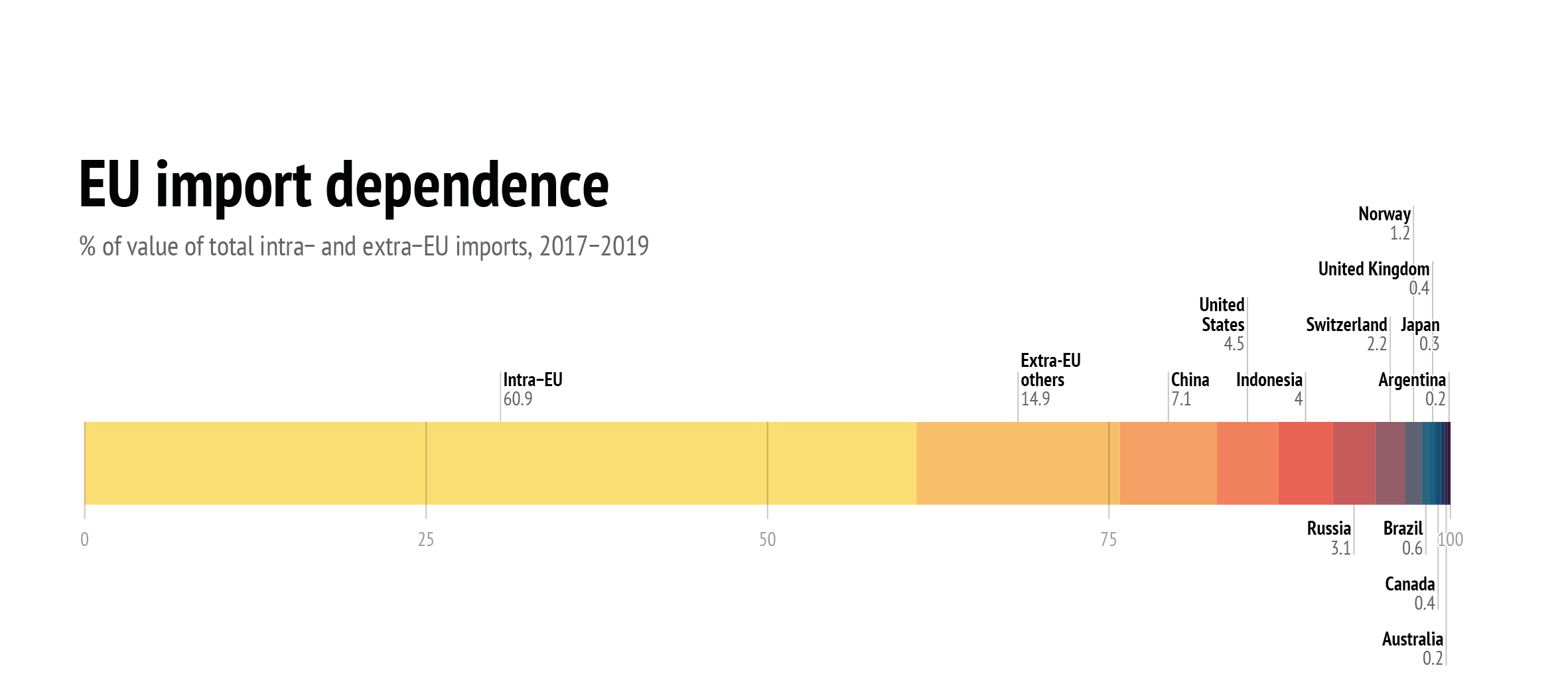

Data: Eurostat, 2020

Of course, the further development of such ideas occurs in an increasingly hostile international environment. It is not only necessary to analyse the risk factors that confront any trade diversification strategy, but to think about future risks and opportunities that may face the Union. To this end, this Brief uses a range of data and indices to assess the EU’s current level of dependence in key technology and product areas and it looks to the horizon to some of the factors that will challenge any diversification strategy including state stability, economic coercion and climate change. In this regard, this Brief differs from analyses that have focused on the benefits of interdependence13 by providing a geopolitically informed take on supply security.

Strategic dependence: scale and intensity

The term ‘geopolitics’ is increasingly used as a blanket term for international affairs, but the issue of supply dependence is a clear cut manifestation of the term: restricting the exportation of critical raw materials or the politicisation of supply chains have the power to damage economies and weaken militaries. Yet, what level of risk does the EU face? To answer this question, we must first provide some context: the reality is that EU member states are interdependent for many products and services within the Internal Market. This has the benefit of cushioning supply shocks, but, as the first wave of the pandemic showed, this counts for little if governments retreat behind national borders for critical supplies. Despite the existence of the Internal Market, the Union is dependent on external supplies, products and technologies, although, as Figure 1 shows, at first glance this dependence appears to be quite limited. For the three-year period examined, the EU appears to have a relatively low overall dependence on China, Russia and the US. So, is the alarm surrounding supply dependence simply an exaggerated response to the grave shortages of medical equipment experienced during the first wave of Covid-19?

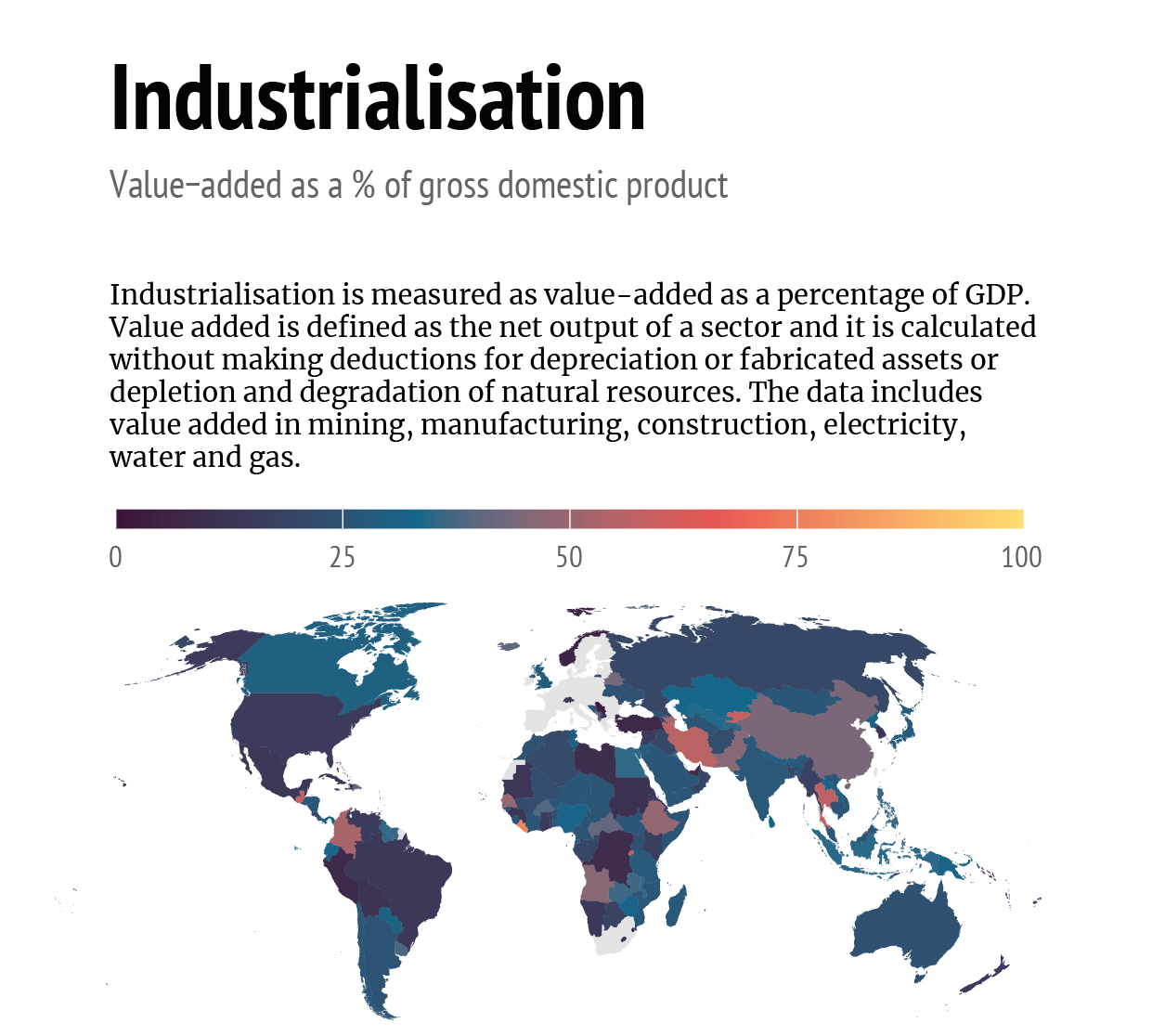

Data: World Bank, 2019

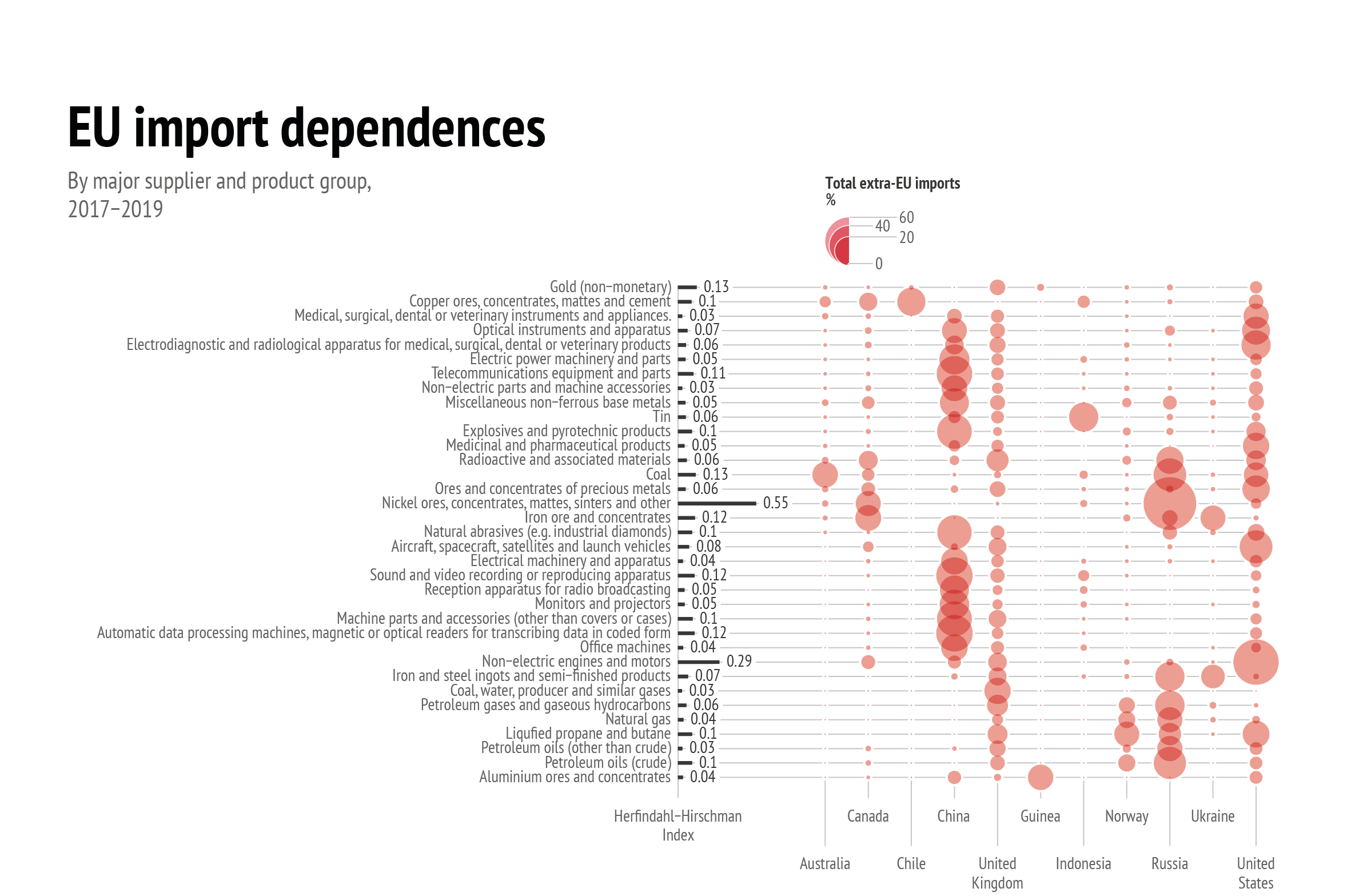

The short answer is no. If we look below the level of overall trade value, we can reveal dependences in some critical product and material groups. Figure 2 calculates the EU’s level of dependence in core areas14 where the Union has a 15%15 or higher dependence rate on a particular product. Based on this data, it is possible to show that the EU has a relatively high dependence on Russia for nickel (72.5%), a resource used in all sorts of manufactured goods such as batteries. Unsurprisingly, the EU also has a high level of dependence on Russian imports of coal, iron, steel and petroleum products. Imports from China across a range of product areas represent the largest proportion of import dependence for the EU, however. The dependence rate is high for automatic data processing machines (33.8%), telecommunications equipment (33.5%) and electric power machinery (31.8%). The Union also has a high dependence rate on US sourced non-electric motors and engines (53.1%), which are used in mining and fossil fuel refining because they are safer than electric engines and motors. American imports of electrodiagnostic and radiological equipment, optical instruments, medical instruments and aerospace products represent a relatively high trade dependence, too. Finally, the EU is dependent on imports of gold from Switzerland and sizeable amounts of iron ore or copper from Brazil, Canada, Chile and Ukraine.

Of course, even though the dependences on Russia and China are particularly concerning, there is a need to recognise the specific dynamics of each form of supply dependency. For example, Russia has the ability to deprive EU member states and NATO allies from energy sources during colder seasons, but it must weigh up the costs of doing so because oil prices are already at historically low levels – and hydrocarbons are the country’s main export. Without oil and gas revenues, Russia will be less able to fund its military and other social investments.16 China is different. Beijing is less dependent on the EU market than Russia because its economy is much more diversified (e.g. in 2019 Russia exported 42% of its total goods to the EU, whereas in 2018 China exported only 15% of its goods to the Union)17. China also provides components and technologies for key infrastructure which can be leveraged in different ways to oil and gas, and can create potential longer-term subterfuge risks (e.g. through cyber-attacks, sabotage, espionage, data mining, etc.).18

Data: Eurostat, 2020

In this sense, looking at the raw data hides the political economy of individual trade relationships. Yet the data also obscures other features of trade dependences, which is an inherent drawback of the available sources. The aggregate-level data we present here is limited by the fact that there is no room to analyse every single material input to a product, and we only look at products that have entered the EU. Accordingly, there is no way to check the ‘suppliers of our suppliers’ (e.g. electromagnetic apparatus imported into the EU will include a range of materials that are integrated into the product outside of the Union).19 This is a noteworthy deficiency associated with trade data, and it means that it is extremely difficult to ascertain a complete picture of material dependences. For example, we know from the data that the EU does not have a harmful dependence on painkillers because it both produces and imports such medicine, but there is a potentially harmful dependence on the Active Ingredients (APIs) that are used to produce them, because those are concentrated in a handful of countries. We do not have the full data to show what level of dependency on APIs exists, however. The same is true of rare earth minerals (REEs), which are used in a variety of technological and digital products. Again, the data presented here does not allow us to look at the REEs that form part of products imported by the EU.

Another potential drawback with the data is that focusing only on the value ignores their concentration and whether the EU has the room to diversify its supplies. This is why, while recognising its limitations, we have applied the Herfindahl-Hirschman Index (HHI) to the data in Figure 2 in order to calculate the level of concentration for each product imported by the EU. The higher the HHI number, the greater the EU’s reliance on a limited number of non-EU suppliers. What does the application of the HHI to the trade share figures reveal? On the one hand, while the EU experiences a relatively high import dependence on aluminium, petroleum oils, natural gas, coal gases, medicinal and pharmaceutical products, non-electric parts, office machines, monitors and projectors, radio broadcasting equipment, electrical machinery and medical instruments, market concentration is low and there is a larger supplier base for these products. On the other hand, there is a higher level of market concentration for products such as nickel, gold, iron, coal, crude oil, liquified propane and butane, non-electric engines and motors, automatic data processing machines, machine parts, telecommunications equipment, and sound and video recording apparatus. For these product groups, there is a smaller supplier base and this points to a far riskier degree of supply dependence. Thus, any study of EU trade dependences needs to look also at the potential for trade diversification and not just specific product dependences.

Managing supply: risk and opportunity

Having now mapped out a number of the EU’s dependences, it is necessary to think about what could be done to manage them. The obvious solution is to strengthen the Internal Market in such a way as to enhance supply solidarity during crises. In this sense, it is important to work with governments and the private actors who ultimately manage supply chains. Another option is to invest in critical technology areas in order to ensure the EU’s mastery of and sovereignty over the digital space. The truth is that decades of de-industrialisation in Europe has led to manufacturing and skills gaps in key sectors, and the push for digital sovereignty will require a sustained effort. This is why Commissioner Breton believes there is a need to promote EU computing power, data control and secure connectivity20 and why the European Council Conclusions of 1-2 October stress the need for ‘Important Projects of Common European Interest’ in areas such as batteries and micro-electronics.21 Yet even if the Union succeeds in this pursuit, there will still be questions about security of supply for raw materials. It is possible to ramp up the EU’s resource conservation and substitution efforts, but, as has been identified in the 2020 Action Plan on critical raw materials, lowering dependences for strategic products will require a broader effort of trade diversification and partnerships.22 However, trade diversification will not be a simple affair because the same geopolitical shifts that are pushing the Union to secure supplies are making diversification harder.

One of the preconditions for trade diversification is that existing and new trade partners have the industrial capacity to produce the types of goods and materials the EU requires. Looking at the share of industrial production23 in each country as a share of their overall Gross Domestic Product (GDP) can help us better understand which countries are best placed to become closer trade partners for the EU. However, we need to be realistic about what this data tells us: for one thing, having a higher level of industrialisation as a proportion of GDP does not mean that a country can produce the full range of goods required as part of any EU diversification strategy or represent an alternate source of materials. For example, the US and Japan have relatively lower levels of industrialisation but they can still supply the EU with high-tech products. Accordingly, higher industrialisation levels are more of an indication of a capacity to produce components or products at lower stages of or as part of lower value chains. China excels in this regard, especially in relation to digital products and manufactured goods, but there are also a number of other countries such as Angola, Argentina, Australia, Canada, Colombia and Ethiopia that have a sufficient level of industrialisation, too.

Simply focusing on industrialisation, however, is only one part of any diversification strategy and it can only provide a one-dimensional reading of the geopolitics of supply. Looking to any future EU trade diversification strategy, this Brief contends that in order to succeed in this effort, the Union will have to grapple with three major factors that will shape its geopolitical environment: state fragility, economic coercion and climate change.

State fragility

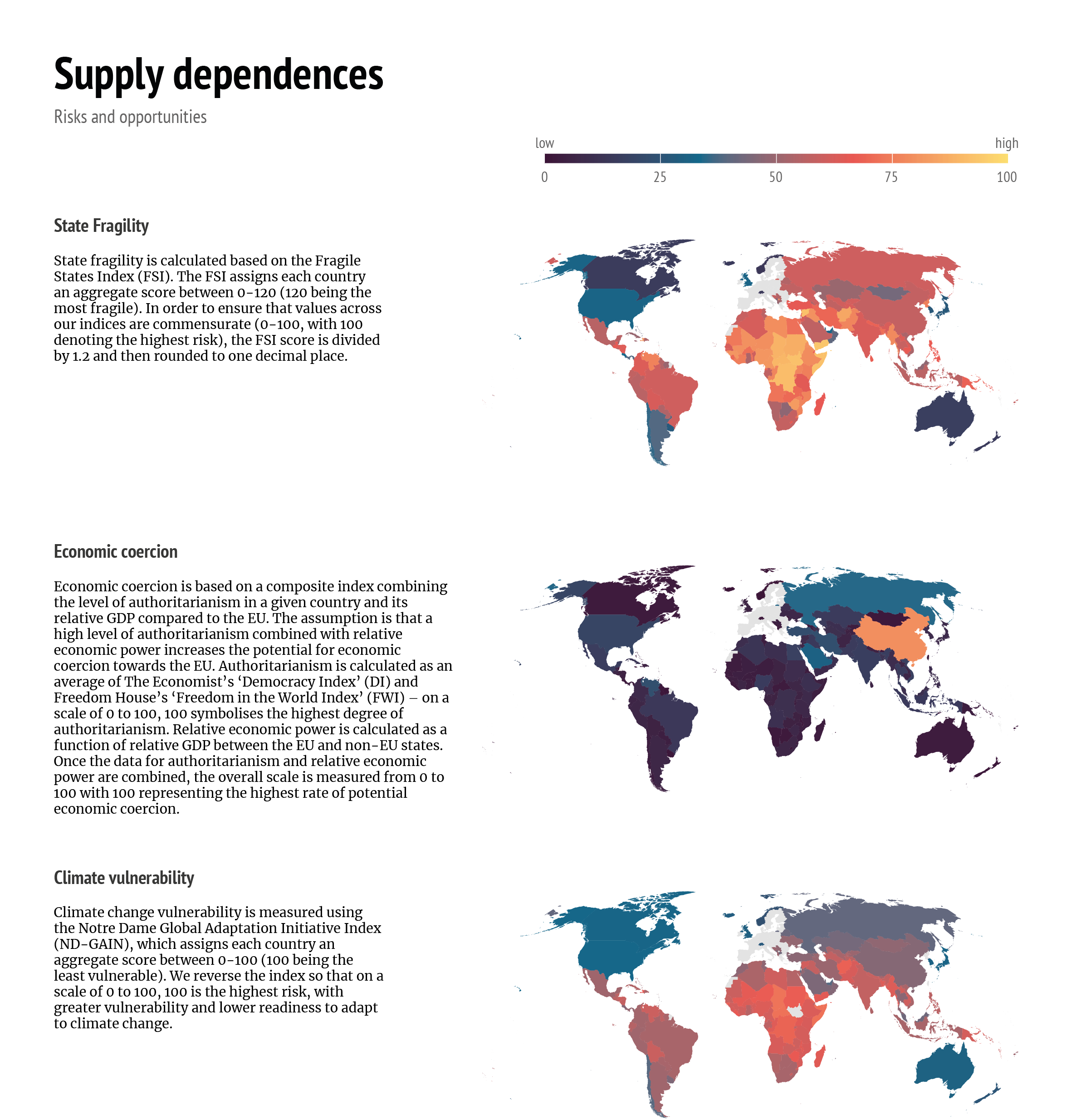

If the EU is to diversify its trade away from risky dependences, then it is questionable whether it should do so with other risky suppliers. In particular, it is worth asking whether the EU should exchange its dependence on a country that can ‘weaponise trade’ for one that is embroiled in breakdowns of governance, coup d’états, civil war, conflict or disease. Alternatively, it may be possible to diversify to stable countries with which the Union already has a strong economic partnership. Looking at the Fragile States Index (FSI),24 it would seem that there is a higher risk in diversifying trade to countries located in Africa, Asia and Central/Latin America and that the EU’s most stable trade partners would be Argentina, Australia, Canada, Japan, the UK and the US. Of course, fragile states can still be traded with and it may be necessary to do so in order to help them avoid further fragility, but high state fragility may hinder an exporter country from investing in the skills, knowledge and industrial capacity it requires to be able to join EU supply chains. Thus, any future geopolitical approach to mitigating state fragility has to hit the ‘sweet spot’ between enhancing trade with existing stable partners and engaging with those states where EU trade can actively contribute to fostering stability.

Economic coercion

In addition to state fragility, the EU has to be weary of falling prey to economic coercion in its trade relations. It is important to understand whether a particular supplier has a willingness to manipulate or disrupt supply flows and whether it has the actual capacity to do so. Smaller economies are less likely to successfully coerce the EU. Given the strain the global trading system is currently under, the EU should expect a higher frequency of potential attempts at economic coercion – whether it be through the implementation of sanctions against EU member states, the haphazard imposition of tariffs or raw material export restrictions. Drawing on peace research,25 we would expect the EU to face the biggest risk of potential economic coercion from authoritarian or non-democratic states that have powerful enough economies to cushion the costs of coercion. If we combine a state’s relative freedom and democracy with its economic power, China comes off as a particularly high potential risk, but so too do Russia, Iran, Saudi Arabia and Turkey. The data also shows that the EU faces a potential risk of economic coercion from the US as well, but not from Australia, Canada or Japan. We can also combine the state fragility and economic coercion data at this point to show that, while many African countries may be more fragile trade partners overall, they are less likely to attempt to coerce the EU through trade.

Data: The Fund for Peace, 2019; The Economist, 2019; Freedom House, 2019; World Bank, 2020; CIA World Factbook, 2019; University of Notre Dame, 2018

Climate change

Another substantial factor that will increasingly play a role in the EU’s considerations about trade diversification is climate change. Save for any radical shift in energy use and global emissions reductions, climate vulnerability is a long-term risk that may aggravate state fragility. As can be seen from Figure 6, countries that are most vulnerable to climate change are generally those that are least developed. Of course, enhancing the EU’s trade relationships with climate vulnerable countries could have the effect of boosting environmental standards and norms, which in turn could lower a country’s overall vulnerability. However, climate vulnerability could adversely affect the potential for trade diversification. Not only could climate shocks such as droughts and flooding hit industrial and agricultural production, but many of the least developed countries still produce carbon intensive products that over time will suffer on global markets as the transition to carbon neutrality accelerates. This means that trade diversification to climate-friendly production needs to occur in vulnerable countries as a way to avoid missing out on investment opportunities and trade in international markets. For the EU, this means that consideration has to be given to whether products being imported contribute to the Union’s ambitious climate targets.

The geopolitics of supply

If the EU is to prepare for a more contested international trading system, it needs to ensure it is ahead of the curve on security of supply while also remaining open for business. Lowering potentially harmful dependences should sit alongside policies being developed by the EU, such as material stockpiling and substitution and developing digital technologies within the Union. In particular, the data analysed in this Brief reveals that now and in the future:

- there are significant risks attached to trade diversification because of state fragility, economic coercion and climate vulnerability, which collectively conspire to limit the number of available suppliers and partners for the EU’s more sensitive dependences;

- a strategy of diversification is most likely to apply to raw materials or components rather than to high-tech areas such as data processors, telecommunications or supercomputing, which require greater investment for self-sufficiency;

- existing EU trade partnerships are a good foundation for diversification. Recently agreed FTAs need more time to flourish but the EU should leverage existing agreements to negate the risks like state fragility, economic coercion and climate vulnerability.

Of course, trade diversification is an area of supply security that will only gather momentum in the current international climate, not least because the transition to a green and digital economy presumes greater need for critical materials and goods. The Commission has already stated in its 2020 Action Plan that in order to cushion potential future raw material shocks, the Union should develop resource partnerships. This certainly tallies with our analysis, although more needs to be done to tie together the Union’s trade, development and resource relationships. There is indeed an urgent need to prepare for an erosion of critical supply security.

There is indeed an urgent need to prepare for an erosion of critical supply security.

As the pandemic has shown, it was readily accepted that there was a high risk of a global virus but this did not lead to sufficient preparedness in the form of joint response exercises or scenarios. The Commission has already usefully produced a foresight report on critical raw materials over the period 2030 to 2050, but what is needed are joint scenario exercises to test the EU’s response in case of product and/or material supply shocks. Scenario exercises are a productive way of sketching out policy responses and bringing together key institutional actors from the Commission and the European External Action Service (EEAS). As this Brief has shown, trade diversification is not simply an economic matter and it requires input from those dealing with security and development, too.

The EU can lower its dependences in the digital domain by developing core technologies.

Beyond foresight and scenarios, however, the EU has the makings of an effective strategy to ensure continued access to critical supplies. With the right level of sustained financial investment, the EU can lower its dependences in the digital domain by developing core technologies, but it also needs to further integrate the Internal Market. It can also work to ensure that it has the raw material inputs for digital technologies by working closely with partners and developing material substitutions. It can also safeguard its knowledge and protect market openness by screening foreign investments, all while encouraging scientific collaboration. It can maximise existing trade relationships while also using trade diversification to promote its environmental standards and sustainable development. The geopolitical stakes are too high for any other approach. The US and China look likely to remain locked in a conflict over trade and recent export laws developed by Beijing threaten to further politicise the matter.26 The EU has no option but to promote multilateral solutions, but its ability to call itself an economic giant is predicated on security of supply.

References

1. See, for example: Keith Johnson and Robbie Gramer, “The Great Decoupling”, Foreign Policy, May 14, 2020, https://foreignpolicy.com/2020/05/14/china-us-pandemic-economy-tensions…; Torsten Riecke, “Resilience and Decoupling in the Era of Great Power Competition”, MERICS China Monitor, August 20, 2020, https://merics.org/en/report/resilience-and-decoupling-era-great-power-….

2. Dalia Marin, Reinhilde Veugelers and Justine Feliu, “A Revival of Manufacturing in Europe? Recent Evidence about Reshoring”, in Reinhilde Veugelers (ed.) Remaking Europe: The New Manufacturing as an Engine for Growth (Brussels: Bruegel, 2017), p. 122.

3. “Reshoring Manufacturing: Should Covid make us Rethink Globalisation?”, Euranet Plus News Agency, May 19, 2020, https://euranetplus-inside.eu/reshoring-manufacturing-should-covid-make….

4. European Commission, “A European Strategy for Data”, COM(2020) 66 final, Brussels, February 19, 2020, https://eur-lex.europa.eu/legal-content/EN/TXT/?qid=1582551099377&uri=C….

5. European Commission, “White Paper on Artificial Intelligence: A European Approach to Excellence and Trust”, COM(2020) 65 final, Brussels, February 19, 2020, https://ec.europa.eu/info/sites/info/files/commission-white-paper-artif….

6. European Commission, “Shaping Europe’s Digital Future”, COM(2020) 67 final, Brussels, February 19, 2020, https://ec.europa.eu/info/sites/info/files/communication-shaping-europe….

7. See: European Commission, “Commission sets out new ambitious mission to lead on supercomputing”, September 18, 2020, https://ec.europa.eu/commission/presscorner/detail/en/ip_20_1592, and European Commission, “Excellence and trust in artificial intelligence”, https://ec.europa.eu/info/strategy/priorities-2019-2024/europe-fit-digi….

8. European Commission, “A New Industrial Strategy for Europe”, COM(2020) 102 final, Brussels, March 10, 2020, p. 14, https://ec.europa.eu/info/sites/info/files/communication-eu-industrial-….

9. European Commission, “Communication on Critical Raw Materials Resilience: Charting a Path Towards Greater Security and Sustainability”, COM(2020) 474 final, Brussels, September 3, 2020, https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX:52020DC0474.

10. European Commission, “Critical Raw Materials for Strategic Technologies and Sectors in the EU: A Foresight Study”, 2020, https://ec.europa.eu/docsroom/documents/42881.

11. Sabine Weyand, “A Stronger Europe in the World: Major Challenges for EU Trade Policy”, College of Europe EU Diplomacy Paper, no. 2, 2020, p.10, https://www.coleurope.eu/system/files_force/research-paper/edp_2_2020_w….

12. Olivier Caslin, “Josep Borrell, chef de la diplomatie européenne: “L’Afrique n’a pas besoin d’un concours de bonté””, JeuneAfrique, May 6, 2020, https://www.jeuneafrique.com/940887/politique/josep-borrell-chef-de-la-….

13. Oscar Guinea and Florian Forsthuber, “Globalization Comes to the Rescue: How Dependency Makes us More Resilient”, ECIPE Occasional Paper, no. 6, 2020, https://ecipe.org/wp-content/uploads/2020/09/ECI_20_OccPaper_06-2020_LY… and Agatha Kratz, Matthew Mingey and Daniel H. Rosen, “Exploring a ‘Green List’ for EU-China Economic Relations”, Rhodium Group Report for Bertelsmann Stiftung, September, 2020, https://www.bertelsmann-stiftung.de/fileadmin/files/BSt/Publikationen/G….

14. Owing to space, we cannot detail every single product line – we ignore product lines such as baby carriages, clothing, works of art and jewellery, pottery or cocoa and instead only focus on areas such as explosives, minerals, engines, digital technologies, metals and precious materials and chemicals.

15. Third states that do not export more than 15% in value of a particular product or material to the EU are not included in the data.

16. See Václav Bartuška, Petr Lang and Andrej Nosko “The Geopolitics of Energy Security in Europe”, in Tomáš Valášek (ed.) New Perspectives on Shared Security: NATO’s Next 70 Years (Brussels: Carnegie Europe, 2019) and Maria Shagina, “Double Shock: The Impact of COVID-19 and the Oil Price Collapse on Russia’s Energy Sector”, Foreign Policy Research Institute, June 4, 2020, https://www.fpri.org/article/2020/06/double-shock-the-impact-of-covid-1….

17. See: European Commission, “Russia”, https://ec.europa.eu/trade/policy/countries-and-regions/countries/russi… and European Commission, “China-EU: International Trade in Goods Statistics”, March, 2020.

18. See: Tim Rühling and John Seaman, “5G and the US-China Tech Rivalry: A Test for Europe’s Future in the Digital Age”, SWP Comment 2019/C 29, June, 2019, https://www.swp-berlin.org/10.18449/2019C29/; NIS Cooperation Group Coordinated Risk Assessment of the Cybersecurity of 5G Networks”, Report, October 9, 2019, p. 14, https://ec.europa.eu/commission/presscorner/detail/en/IP_19_6049; and Eline Chivot and Raquel Jorge-Ricart, “The EU’s Approach to 5G and the Reshaping of Transatlantic Relations”, European Leadership Network, Commentary, September 10, 2020, https://www.europeanleadershipnetwork.org/commentary/the-eus-approach-t….

19. In terms of granularity, we work with aggregate-level data (Standard International Trade Classification 3-digit code – SITC 3). Admittedly, this does not include each and every individual product or raw material input for a product but nor is the data comprehensive enough to do so. SITC 3 allows us to measure dependence in terms of value and for product/material groups rather than specific products/materials. So, and to draw on an earlier example, the overall value of India’s medicinal exports to the EU is relatively low in value, despite the fact that the country is a major supplier of (cheap) generic pharmaceuticals and APIs, which implies that the country will not meet the 15% threshold mentioned in endnote 14.

20. Thierry Breton, “Europe: The Keys to Sovereignty”, European Commission, September 11, 2020, https://ec.europa.eu/commission/commissioners/2019-2024/breton/announce….

21. European Council, “Conclusions – 1-2 October 2020”, EUCO 13/20, Brussels, October 2, 2010, https://www.consilium.europa.eu/media/45910/021020-euco-final-conclusio….

22. Op.Cit., “Communication on Critical Raw Materials Resilience”.

23. Measured as production in manufacturing, mining, construction, electricity, water and gas.

24. The FSI brings together twelve separate indictors including state legitimacy; human rights and rule of law; public services; demographic pressures; refugees and Internally Displaced Persons (IDPs); external intervention by foreign governments, militaries and intelligence; brain drain; economic development; economic decline; fragmentation of state institutions; occurrence or risk from terrorism, war, rebels, mutinies or coups; and divisions within society between groups. See: The Fund for Peace, “Fragile States Index - Indicators”, 2018, https://fragilestatesindex.org/indicators/.

25. See, for example, Geoffrey P R Wallace, “Regime Type, Issues of Contention, and Economic Sanctions: Re-evaluating the Economic Peace between Democracies”, Journal of Peace Research, vol. 50, no. 4, 2013, pp. 479-493.

26. Chao Deng, “China adds new export restrictions in latest trade-dispute move”, Wall Street Journal, October 19, 2020, https://www.wsj.com/articles/china-adds-new-export-restrictions-in-late….