You are here

Building weapons together (or not)

Introduction

In the shadow of Russia’s war of aggression against Ukraine, the EU and its Member States are undertaking the biggest rearmament effort to take place in Europe since the 1950s. Many now call for more European cooperation on not only buying weapons together but also on building weapons together (1). The argument is that building weapons together will not only be cheaper but also strengthen the European Defence Technological and Industrial Base (EDTIB) by consolidating supply in fewer producers, thereby incurring economies of scale. But how fragmented is the European defence industry in reality, and is it always better to have fewer producers of key defence systems? And what about the role of competition in driving innovation and cost control?

Defence is primarily a Member State responsibility in the EU. In support, however, the European Commission has launched ground-breaking initiatives using the EU budget to strengthen defence cooperation and the EDTIB. These initiatives include €8 billion for defence research and development provided in the European Defence Fund (EDF), €300 million in incentives for joint procurement through the European Defence Industry Reinforcement Through Common Procurement Act (EDIRPA), and €500 million for ramping up ammunition and missile production earmarked under the Act in Support of Ammunition Production (ASAP). Member States have also pooled €12 billion outside the EU budget for armaments to partner countries under the European Peace Facility (EPF) mechanism and are jointly ordering ammunition through the European Defence Agency (EDA). With no end to the war in Ukraine in sight and faced with the prospect of a protracted conflict with Russia, the Commission is preparing a European defence industry strategy to further strengthen the EDTIB (2).

This Brief argues that new EU initiatives should focus on long-term demand for critical strategic capabilities to provide stable markets, but also facilitate competition in the defence industrial sector, wherever this is possible, to promote innovation and cost control. The Brief is divided in two sections. The first addresses the call for more defence industrial consolidation and the argument that competition is key for innovation and cost control. The second proposes support the EU could provide to the EDTIB by:

- supporting long-term demand for critical enablers such as strategic transport, SatCom services and airborne surveillance;

- funding of infrastructure suitable for ammunition storage and for refurbishing air and naval bases; and

- subsidising cross-certification of ammunition.

In the conclusion, some reflections are offered on the future of the European defence industry.

Consolidation and competition

For the past 25 years, a common argument by EU institutions and analysts alike has been that the European defence industry is too fragmented and too structured along national borders to be sustainable (3). This fragmentation and national focus are said to lead to costly duplications and reduced competitiveness due to a lack of economies of scale in R&D and production. A comparison is typically made with the United States where fewer types of systems are produced by two or three contractors or in some cases even just a single prime contractor and production line. The conclusion is therefore that Europe should likewise consolidate its defence industry into a few ‘European champions’.

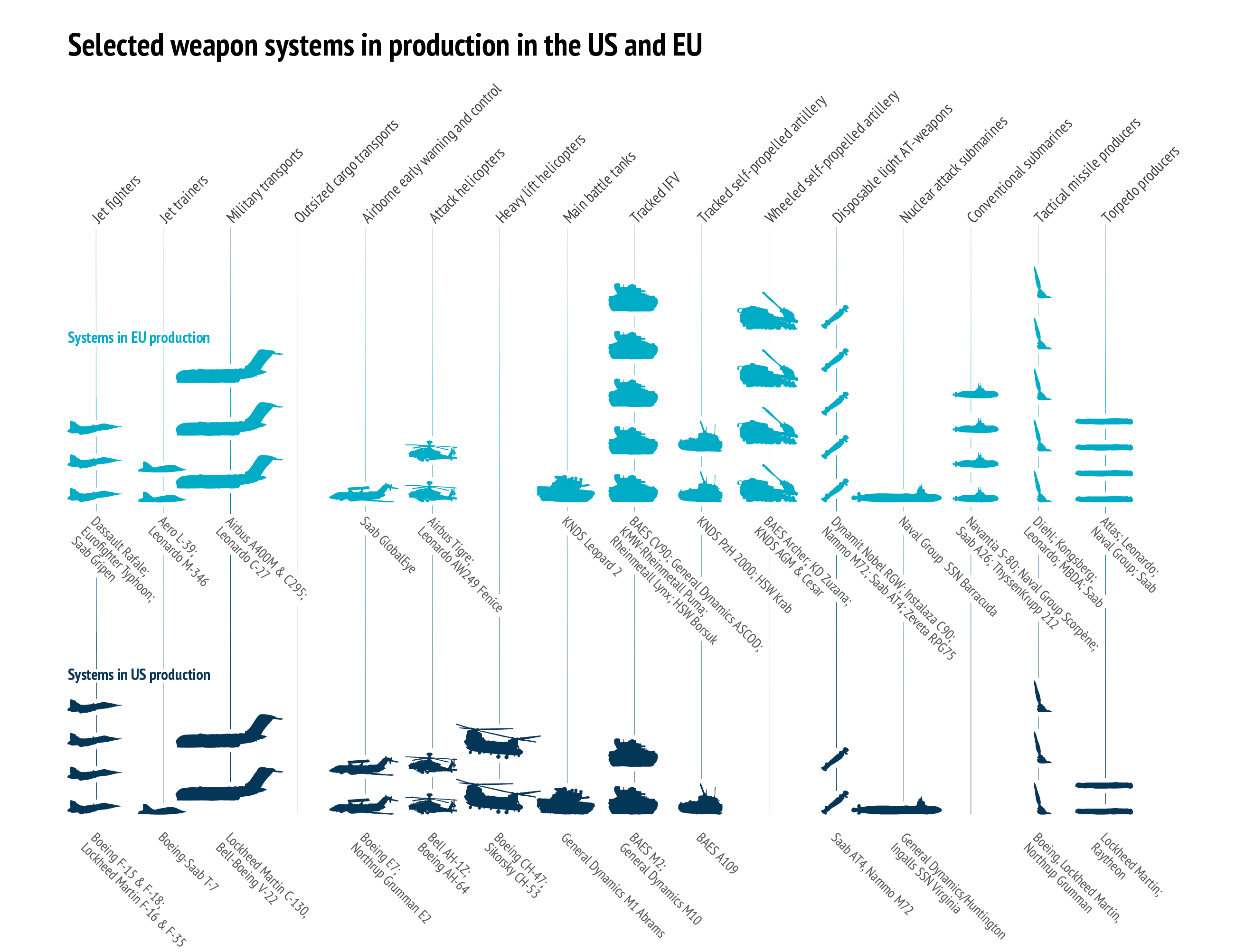

However, the European defence industry may not be as fragmented as is often assumed. A common mistake is to equate the number of systems amassed over decades in the inventories of Europe’s armed forces with systems in active production. As the table on the next page shows, the number of key weapon systems in production in the EU is in fact largely comparable to the US, except for naval shipbuilding. For example, the only active production line for new Main Battle Tanks (MBTs) in the EU since 2008 is for the Leopard 2, just as the only production line for MBTs in the US is for the M1 Abrams. There are three different fighter jets being actively produced in the EU while there are four in the US, and while there is only one Airborne Early Warning & Control (AEW&C) system produced in the EU, there are two competing in the US.

It is hard to see single European-wide programmes anytime soon in key platforms.

In most industries, consolidation follows customer behaviour. If the European defence industry were to further merge along the lines of the United States, there would likely have to be similar types of single large programmes such as for the F-35 Joint Strike Fighter (JSF). While the Pentagon is the sole customer in the US and can place industry-shaping contracts, there is no single customer in Europe. There have therefore only been a few instances of European-wide defence industrial consolidation. It is also hard to see single European-wide programmes anytime soon in key platforms (4). But even if it were possible to agree on one European programme for every weapon system, would it be good defence industrial policy?

In Europe, the dominant provider of jet fighters is the American company Lockheed Martin with its F-35 Joint Strike Fighter selected by 10 European countries, with more set to follow suit. Eventually, some 500 F-35s could be in the skies over Europe (5). The argument goes that, with a planned production run of some 2 400 for the US Airforce, Marines and Navy alone, Lockheed Martin can benefit from economies of scale to offer better prices and more advanced design than anything offered by the fragmented European industry.

The commercial success of the F-35 has led to pressures in Europe to cooperate on the next generation fighter jet and associated systems. Accordingly, France, Germany and Spain are committed to a joint effort for a Future Combat Air System (FCAS) whereas Italy and the UK have teamed up together with Japan in a Global Combat Air Programme (GCAP) to develop top-of-the-line fighters by 2040. But would it not be better to concentrate all efforts in one European programme like in the US? Perhaps, but the fact that the four countries and industry partners participating in the existing trans-European cooperation on fighters since the 1990s, the Eurofighter consortium, are now on opposite sides in the competing FCAS (Airbus Germany and Indra of Spain) and GCAP (BAE Systems and Leonardo of Italy) programmes is telling (6). While both are progressing slowly, the deep frictions over design leadership and workshare in the Franco-German-Spanish cooperation and the fact that Sweden quietly withdrew from the GCAP programme, show the challenges of building weapons together (7).

Diverging national requirements, design philosophies, and political and industrial interests make it difficult to agree. For example, French requirements for multirole combat aircraft also suitable for conventional carrier operations and for exports have often been impossible to merge with the heavy long-range interceptors that the UK and Germany have traditionally sought (8). Additionally, Swedish requirements for agile fighters optimised for dispersed operations from short highway road bases with minimal ground crew support have led to the emergence of yet another design philosophy in Europe over the past 50 years. Similar differences exist in MBTs with France, for example, traditionally preferring lighter armoured vehicles for operations outside of Europe while German requirements have consistently been for heavily armoured tanks to fight a Soviet/Russian invasion in central Europe. Perhaps not surprisingly, attempts at European-wide cooperation on MBTs have consistently failed and the current Franco-German project of a future Main Ground Combat System (MGCS) launched in 2017 as the next ‘European’ MBT remains much in doubt (9).

Different national war-fighting requirements and competing industrial and political interests have repeatedly led to failures in agreeing on single programmes big enough to drive defence industrial consolidation at the European level from the top. The procurement decisions over the past decade, and a trend reinforced by the wave of new orders by Member States for aircraft, tanks, air defence systems and missiles to the tune of €100 billion since the Russian war of aggression in Ukraine, will likely entrench these differences in the EU for years to come (10). In the short to medium term, there is therefore a risk that the window of opportunity for new big European-wide programmes is closing.

We few, we happy few

However, consolidation of the defence industry may not be the one solution to fix it all. In February 2022, the Pentagon released a major report by the Office of the Under Secretary of Defense for Acquisition and Sustainment underlining that the US defence industrial base had shrunk dramatically (11). Over the last 30 years, the number of US suppliers of tactical missiles dropped from 13 to 3; fixed-wing aircraft suppliers from 8 to 3; and only one producer of MBTs remains. According to the Pentagon, competition within the defence industry is vital since ‘when markets are competitive, the Department reaps the benefits through improved cost, schedule, and performance for the products and services needed to support national defense’. The report concludes that the lack of diversity of suppliers ‘decreases the kind of competition that spurs innovation and lowers prices paid for defence materials by the taxpayer’ (12). As a result, the Pentagon will promote more competition and ensure that it is fair and open for future programmes as a critical DoD priority (13).

Consolidation will not by itself lead to competitiveness.

Concerns about the risks of consolidating the defence industrial base are not new. Already in 1998, the US Government Accounting Office (GAO) warned of the consequences of the wave of mergers following the so-called ‘Last Supper’ in 1993, when the Pentagon told the defence industry to consolidate (14). Even the architect of the policy, former US Defence Secretary William J. Perry, stated in 2015 that in hindsight the ‘Last Supper’ had led the industry to become less competitive and that ‘we would have been better off with more, smaller firms than with a few large ones’ (15). In this context, the F-35 programme is often held up as a warning of how one programme can become too big, too complicated and too expensive, but in the absence of any remaining competitors impossible to cancel (16).

Consolidation will not by itself lead to competitiveness. Arguably, competition encourages the very innovation and cost control that makes European industry competitive. After all, the Leopard 2 has become the standard European MBT in service with 14 European armies, but only after repeated evaluations, improvements, and contract competitions against British, French, Italian, Swedish, US, Russian and South Korean designs over the past 40 years. With some 3 500 produced, the Leopard 2 is often mentioned as the best MBT in the world (17). Similarly, in other sectors often cited as too fragmented like tracked infantry fighting vehicles (IFVs) there are in fact only a handful of European models on the market. Of these, the CV90 has been selected by 10 European countries after often vigorous competition with some 1 800 delivered or on order (18).

Bring it on!

Twenty years ago, competition was the main thrust of EU initiatives in the defence market. In September 2004, the Commission presented a Green Paper on defence procurement for ‘the gradual creation of a European defence equipment market’. (19). Five years later, the Commission set up an EU framework for such a market through Directive 2009/43/EC on intra-EU transfers of defence-related products and Directive 2009/81/EC on defence and security procurement (20). While these directives introduced transparent rules for industry to access defence markets in all EU Member States, they also allowed governments to exempt defence and security contracts from competition if this could be justified by essential national security interests (Article 346 TFEU).

In practice, however, applying Article 346 became the rule rather than the exception for Member States. In an evaluation in 2015, a report to the European Parliament (EP) stated that ‘acquisition practices seem to show an incomplete and incorrect application of the Directive, with de facto a limited or even non-existent impact on the [E]DTIB’ (21). In 2020, another EP report found that exceptions are still common practice but that it was ‘a matter of policy consistency to ensure that the EU’s efforts to support defence industry’s competitiveness and the emergence of a truly European Defence Technological and Industrial Base through the European Defence Fund are not weakened by the poor application of Directive 2009/81/EC’ (22). If competition indeed drives the defence industry ‘to offer its best technical solutions at a best-value cost and price’, as the Pentagon argues, the EU could do well to more firmly enforce the competition rules that exist (23).

Ways to strengthen the European defence industry

Beginning in the 1990s, the European defence industry was under pressure. Shrinking defence budgets and increasing competition in export markets led to calls for EU support. The Commission’s ambition to create a European defence equipment market was one response to these calls while the use of the EU budget for defence-related research and development in the EDF was another. Today, the situation is different. The EU response this time has been to incentivise joint procurement among Member States and support to European industry for ramping up ammunition production in the short term. At the same time, many Member States are spending significant amounts of their acquisition budgets outside Europe, with American, Israeli and South Korean companies.

With many contracts for new tanks, aircraft and ammunition already placed, and no agreements on European-wide single programmes in the short or even medium term in key areas such as MBTs, fighter aircraft or submarines, the EU needs to rethink how to strengthen the EDTIB for the long haul. Given the limits of the EU Treaties, the EU could play a decisive role by complementing its current R&D funding by creating more demand for dual-use strategic enablers; funding infrastructure for ammunition storage and for refurbishing air and naval bases; and subsidising the cross-certification of ammunition.

Demand for strategic enablers

While EU Member States may disagree on the requirements for tanks or fighter aircraft, there is wide agreement on the need for strategic enablers that few, if any, individual EU Member States can afford on their own and where there exist only one or few European options. Strategic transport, satellite communication and airborne surveillance are three examples that are also needed for the Rapid Deployment Capacity (RDC) that the EU in its Strategic Compass has pledged to ensure is fully operational by 2025. These enablers are also of a dual-use nature and can even be provided as a service if long-term demand exists. The EU could thus strengthen market demand by committing at the European level to fund the acquisition of such systems directly or by buying significant annual ‘hours of service’ on behalf of Member States.

There is wide agreement on the need for strategic enablers.

Strategic transport

The lack of strategic air transport is a long-standing European shortfall. Arguably, one of the best kept secrets of European and transatlantic defence cooperation is the independent Strategic Airlift Capability (SAC) Programme. Lacking their own strategic transport, 11 European countries joined the US in 2008 to jointly buy and operate strategic transport aircraft for a period of at least 30 years (24). SAC currently operates three Boeing C-17 Globemaster III aircraft from its base in Hungary. Each member ‘owns’ yearly flying hours proportionate to their share of the programme. The EU could join the SAC either as a partner or by committing to long-term funding of flight hours via existing partners. In either case, the extra long-term demand would allow for more aircraft. The C-17 production line is however closed, so acquiring Airbus A400M could be an option, but larger aircraft will eventually be needed. To address this gap, a PESCO project on Strategic Air Transport for Outsized Cargo (SATOC) was launched in 2021 to identify sufficient demand, and then harmonise requirements for a common European solution (25). If the EU were to join the SAC and commit to a significant number of flying hours, the case for a European SATOC solution would be strengthened.

Satellite communication

Other critical enablers for European security and defence are satellite communication (SatCom) and Communication and Information System (CIS) services. Well-functioning SatCom and CIS services are necessary for command and control of missions in remote areas and for communications between field headquarters and capitals. These services can be provided by government-owned assets that can be pooled and shared with other Member States, but also by industry. For example, many Member States and EU missions already pool demand for commercially available SatCom and CIS services in framework contracts negotiated by the EDA (26). To ensure stable demand for these services and to support the EDTIB, the EU could commit at the Union level to fund long-term annual contracts for SatCom and CIS services.

Industry structure follows customer behaviour.

Air and maritime surveillance & control

Another key strategic enabler for the EU is air and maritime surveillance and command and control capabilities. As a Union with continent-wide borders and air and sea lines of communication stretching around the world, the EU needs comprehensive air and maritime surveillance capabilities. Known as airborne early warning and control (AEW&C) systems, they are often deployed on modified airliners or business jets carrying advanced sensors to detect moving objects such as aircraft, missiles, ships, and vehicles at very long ranges. They are a key component for air defence, border controls and search and rescue operations. NATO and a handful of EU Member States operate AEW&C systems but NATO assets may not be available for political or operational reasons as the Alliance’s 14 Boeing E3A aircraft are in heavy use and rapidly ageing. In support of EU needs and to strengthen the EDTIB, the EU could initiate an AEW&C programme at the Union level. Such a programme could be based on the existing Saab GlobalEye solution and organised like the SAC programme mentioned above or the Multirole Tanker Transport cooperation in which six European countries came together to jointly procure and operate a fleet of Airbus A330 tanker aircraft.

In either case, EU Member States with the support of EU entities could jointly procure and operate AEW&C platforms for Union and Member States’ needs. Another possible option could be for the EU and interested Member States to commit to long-term buying of services that could be provided by industry like the EU SatCom market referred to earlier (27).

Funding infrastructure

Today, much focus is on ramping up production of ammunition and new orders for aircraft, tanks and ships. However, all that kit must be stored somewhere. At the end of the Cold War, much of the infrastructure for large-scale war in Europe was dismantled or sold. To build and certify the necessary storage for all the new shells and missiles ordered across Europe will be a major challenge. While NATO is preparing new ammunition storage sites on the territory of its eastern frontline Allies, the EU could play a key role in subsidising this effort across the EU Member States. A similar argument can be made for EU level support for expanding, refurbishing and adapting existing army, airforce and naval base infrastructure. This will also indirectly support the EDTIB since Member States will be able to spend more on ammunition and equipment than on storage facilities and base infrastructure.

Cross-certification of ammunition

To ensure interoperability in defence, countries need to share a common set of standards – the rules that ensure practical functionality. In NATO, there are standards on everything from ammunition calibres to rail gauges. However, there are still no guarantees that a particular bullet or shell will fire the same way across different systems unless certified in tests. It is therefore common practice that a producer of a weapon system also sells approved ammunition. To certify ammunition manufactured by others, however, requires an elaborate process of repeated test firing under varying conditions to guarantee given specifications. For artillery, for example, this can be a lengthy and costly process. By subsidising the cost for cross-certification of ammunition against a variety of systems, the EU could contribute to more interoperability and enhance competition as well as the competitiveness of European producers since their products would be certified against a wider range of systems.

Conclusion

Over the past 25 years, it has repeatedly been argued that the European defence industry is too fragmented, and that building weapons together would not only be cheaper but also strengthen the EDTIB by consolidating supply in fewer producers.

However, even if consolidation may be warranted in some industrial sectors, the EDTIB may be less fragmented than often believed. Rather than calling for centrally directed consolidation, this Brief argues for facilitating competition when and where possible, to not only push innovation and cost control but also as a way to drive consolidation via the market.

Industry structure follows customer behaviour. With few European-wide programmes on the horizon and the massive rearmament now taking place often privileging existing supplier-customer relationships, there is little to drive a major restructuring of the European defence industry. The EU could however play a key role in supporting the EDTIB by ensuring competition where possible and supporting demand for dual-use strategic enablers such as strategic transport, SatCom and CIS services, and AEW&C systems, as well as funding strategic infrastructure and cross-certifying ammunition. This would not only strengthen the European defence industry but also the security of the EU and its Member States – which is, after all, the ultimate purpose of having a European defence industry.

References

*The author would like to thank a number of current and former colleagues, and subject matter experts, for valuable comments and suggestions, Sascha Simon for research assistance as well as Christian Dietrich for his work on the graphics.

1. On joint procurement, see Andersson, J.J., ‘Buying weapons together (or not): Joint defence acquisition and parallel arms procurement’, Brief no 7, EUISS, 3 April 2023 (https://www.iss.europa.eu/content/buying- weapons-together-or-not).

2. Announced by European Commission President Ursula von der Leyen in September 2023 (https://www.euractiv.com/section/defence-and-security/news/european-defence-industry-strategy-in-the-works-von- der-leyen-confirms/).

3. See, for example, European Commission, ‘Strategy for the survival of the European defence industry’, 14 November 1997 (https://cordis.europa.eu/ article/id/9338-strategy-for-the-survival-of-the-european-defence- industry); European Commission and HRVP, ‘Joint Communication on the defence investment gaps analysis and way forward’, JOIN(2022) 24 final, 18 May 2022 (https://commission.europa.eu/publications/defence- investment-gaps-and-measures-address-them_en) and numerous think tank reports. A notable exception is Béraud-Sudreau, L. and Scarazzato, L., ‘Fragmentation? Mapping the European defence industry in an era of strategic flux’, CSDS In-Depth, July 2023 (https://brussels- school.be/sites/default/files/In-Depth-Beyond-Fragmentation.pdf).

4. Perhaps helicopters can become an exception: see ‘Six NATO countries sign agreement to collaborate on next-gen helo’, Defense News,16 June 2022 (https://www.defensenews.com/global/2022/06/16/ six-nato-countries-sign-agreement-to-collaborate-on-next-gen-helo/#:~:text=Six%20NATO%20countries%20sign%20agreement%20 to%20collaborate%20on%20next%2Dgen%20helo,-By%20Jen%20 Judson&text=PARIS%20%E2%80%94%20Six%20NATO%20countries%20 signed,alliance%20defense%20ministers%20in%20Brussels.).

5. Lockheed Martin, ‘F-35 Lightning 2’ (https://www.f35.com/f35/global- enterprise/united-states.html).

6. Dassault of France is part of FCAS.

7. ‘Paris Air Show news: Europe’s next-gen jet fighter makes little progress in four years’, National Defense, 20 June 2023 (https://www. nationaldefensemagazine.org/articles/2023/6/20/europes-next-gen-jet-fighter-makes-little-progress-in-four-years); Osborne, T., ‘Sweden preparing for future combat aircraft studies’, AviationWeek.com, 19 June 2023 (https://aviationweek.com/shownews/paris-air-show/sweden- preparing-future-combat-aircraft-studies).

8. Lorell, M. and Hoffman, D., ‘The use of prototypes in selected foreign fighter aircraft development programs’, RAND Report, September 1989,p.12 (https://www.rand.org/pubs/reports/R3687.html).

9. Andersson, J.J., ‘Cold War dinosaurs or hi-tech arms providers? The West European land armaments industry at the turn of the millennium’, WEUISS Occasional Papers no 23, 1 February 2001 (https://www.iss.europa. eu/content/cold-war-dinosaurs-or-hi-tech-arms-providers-west- european-land-armaments-industry-turn); ‘The future of the MGCS program is getting darker by the day’, Meta-Defence, 5 September 2023 (https://meta-defense.fr/en/2023/09/05/programme-mgcs-avenir- sombre/).

10. Maulny, J-P., ‘The impact of the war in Ukraine on the European defence market’, Policy Paper, IRIS, September 2023, pp.15-18 (https://www. iris-france.org/wp-content/uploads/2023/09/19_ProgEuropeIndusDef_ JPMaulny.pdf).

11. US Department of Defense Report, State of Competition within the Defense Industrial Base, Office of the Under Secretary of Defense for Acquisition and Sustainment, February 2022, p.1 (https://media.defense.gov/2022/ Feb/15/2002939087/-1/-1/1/STATE-OF-COMPETITION-WITHIN-THE- DEFENSE-INDUSTRIAL-BASE.PDF).

12. Ibid.

13. US Department of Defense, ‘State of competition in the Defense Industrial Base’, 15 February 2022 (https://www.defense.gov/News/ Releases/Release/Article/2934955/state-of-competition-in-the-defense- industrial-base/).

14. ‘Defense Industry Consolidation: Competitive Effects of Mergers and Acquisitions’, Statement of David E. Cooper, Associate Director, Defense Acquisitions Issues, National Security and International Affairs Division, United States General Accounting Office, 4 March 1998 (https://www. gao.gov/assets/t-nsiad-98-112.pdf).

15. ‘Former SecDef Perry: Defense industry consolidation has turned out badly,’ National Defense, 2 December 2015 (https://www. nationaldefensemagazine.org/articles/2015/12/2/former-secdef-perry- defense-industry-consolidation-has-turned-out-badly#).

16. ‘The fighter jet that’s too pricey to fail. The F-35 is a boondoggle. Yet we’re stuck with it’, The New York Times, 12 March 2021 (https://www. nytimes.com/2021/03/12/opinion/f-35-fighter-jet-cost.html); ‘The $1 trillion question: is the F-35 project too big to fail?’ Air Force Technology, 16 July 2018, (https://www.airforce-technology.com/features/f-35- project/?cf-view).

17. ‘Explainer: West mulls sending German Leopard 2 tanks to Ukraine’, Reuters, 16 January 2023 (https://www.reuters.com/world/europe/west- mulls-sending-german-leopard-2-tanks-ukraine-2023-01-13/).

18. ‘The Slovak MoD selects the CV90 as preferred bidder for its IFV programme’, European Defence Review, 27 May 2022 (https://www. edrmagazine.eu/the-slovak-mod-selects-the-cv90-as-preferred- bidder-for-its-ifv-programme).

19. Commission Green Paper on defence procurement, (COM(2004) 608 final), 24 September 2004 (https://eur-lex.europa.eu/EN/legal-content/ summary/defence-procurement.html).

20. Directive 2009/43/EC of the European Parliament and of the Council of 6 May 2009 simplifying terms and conditions of transfers of defence-related products within the Community (Text with EEA relevance) (https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=celex%3A32009L0043); Directive 2009/81/EC of 13 July 2009 on the coordination of procedures for the award of contracts by contracting authorities or entities in the fields of defence and security (https://eur- lex.europa.eu/legal-content/EN/TXT/?uri=celex%3A32009L0081).

21. ‘The impact of the ”defence package” Directives on European defence’, European Parliament Study, June 2015, p. 6 (https://www.europarl. europa.eu/RegData/etudes/STUD/2015/549044/EXPO_STU(2015)549044_ EN.pdf).

22. Ioannides, I., (ed.), ‘EU Defence Package: Defence Procurement and Intra-Community Transfers Directives –European Implementation Assessment’, EPRS Study, October 2020, p. 145 (https://www.iris-france. org/wp-content/uploads/2020/10/EPRS_STU2020654171_EN.pdf).

23. In a rare case, the European Commission fined two defence companies for illegal cartel cooperation on the sale of hand grenades. See, ‘Antitrust: Commission fines defence company €1.2 million in cartel settlement’, EC Press Release, 21 September 2023 (https://ec.europa.eu/ commission/presscorner/detail/en/ip_23_4531).

24. Andersson, J.J., ‘Pooling and sharing that works: The Heavy Airlift Wing at five’, EUISS Alert, 21 October 2014 (https://www.iss.europa.eu/content/ pooling-and-sharing-works-heavy-airlift-wing-five).

25. Permanent Structured Cooperation (PESCO), ‘Strategic Air Transport for Outsized Cargo (SATOC)’, (https://www.pesco.europa.eu/project/ strategic-air-transport-for-outsized-cargo-satoc/).

26. European Defence Agency, ‘Factsheet: EU SatCom Market’, 20 January 2021 (https://eda.europa.eu/publications-and-data/latest-publications/ factsheet-eu-satcom-market).

27. While AEW&C services may not yet exist on the commercial market, encrypted data could in principle be downloaded from industry-owned airborne platforms to national or EU command centres on the ground. There are already commercial companies offering airborne intelligence, surveillance and reconnaissance services to Member States and EU missions. See for example, CAE Aviation (https://www.cae-aviation.com/ en/cae-aviation-english/).