In 1999, China launched its ‘Go Out policy’, while from 2014, India pursued closer engagement with regions such as the Middle East via its ‘Look West policy’. Since that time Chinese and Indian companies have expanded overseas and dramatically stepped up their investment in the Arab World and Sub-Saharan Africa.

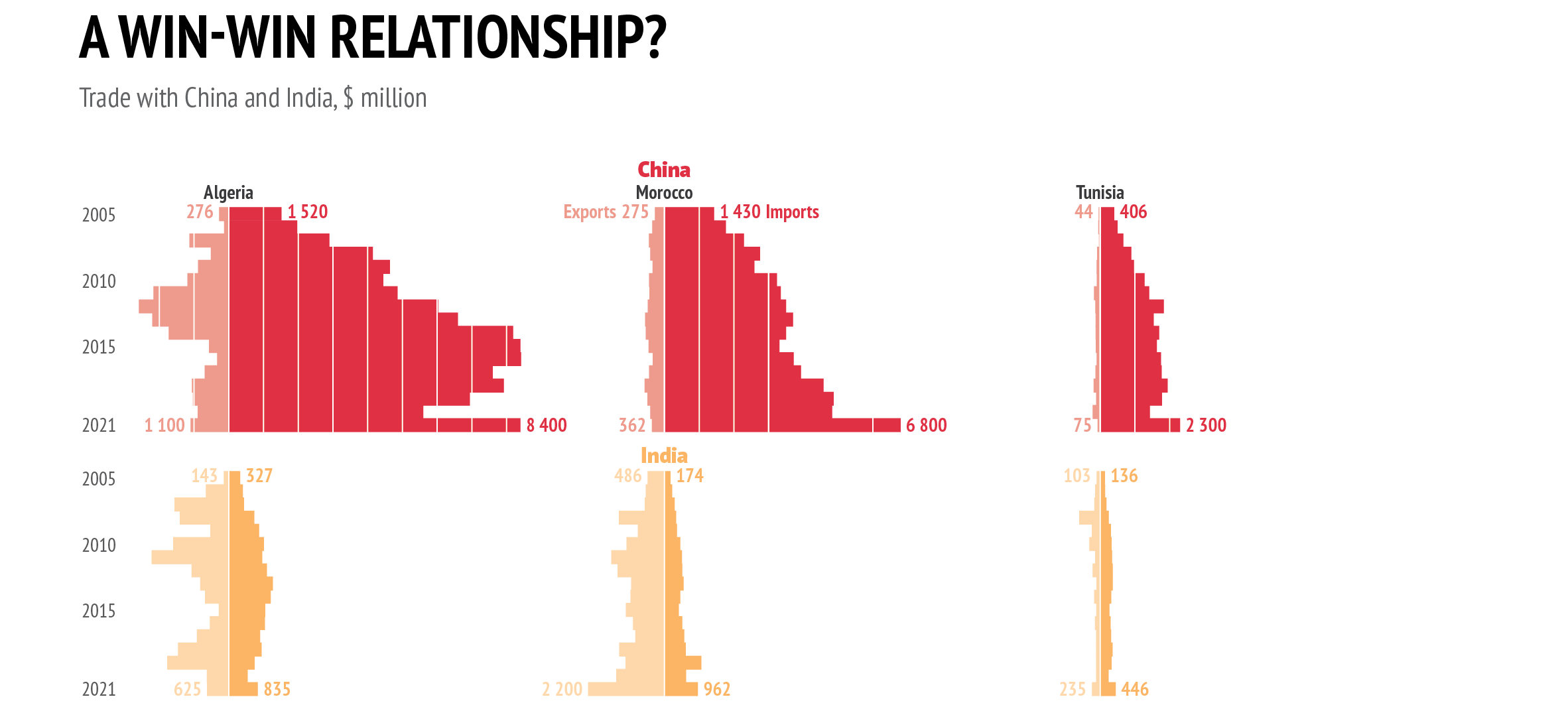

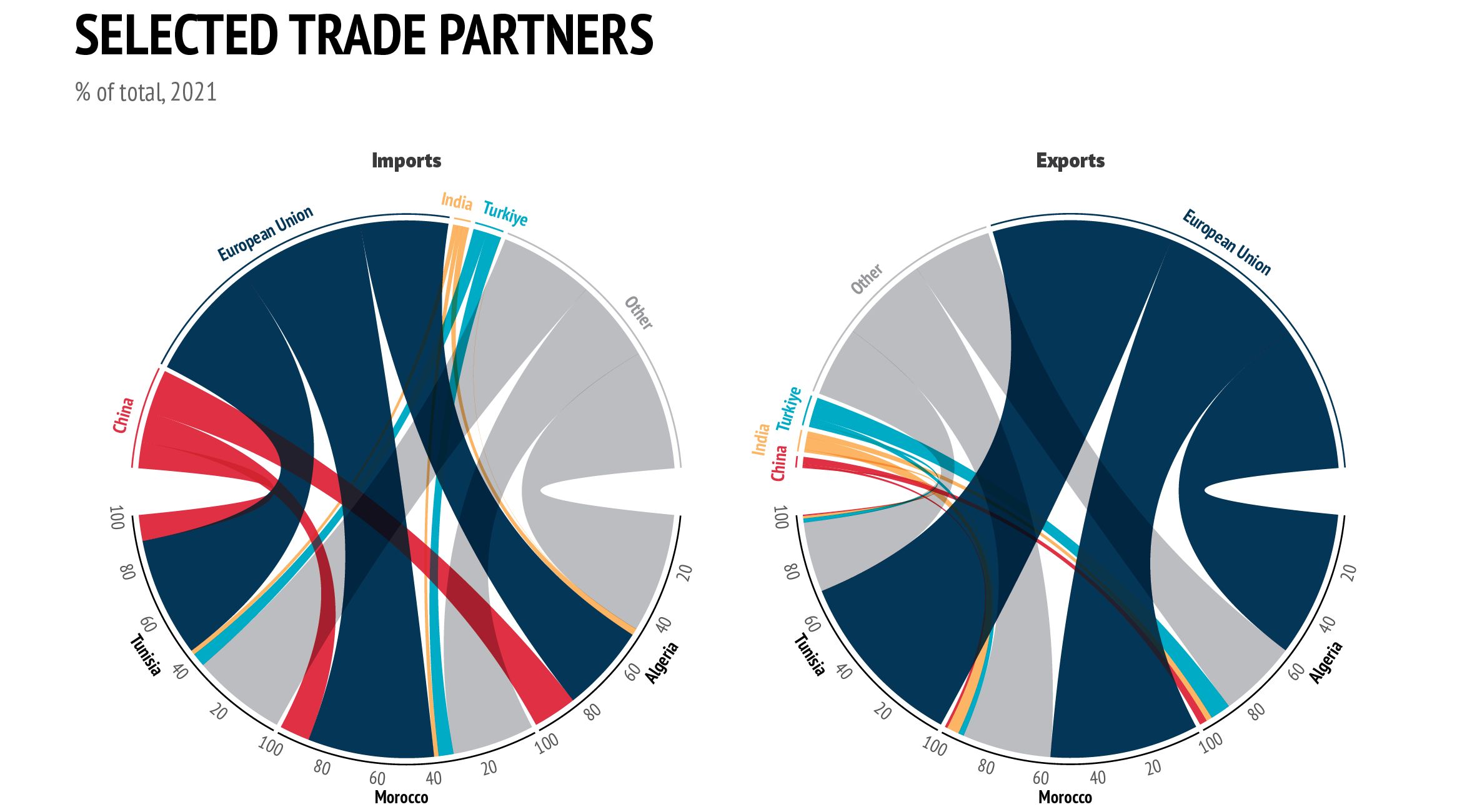

Nonetheless, China’s and India’s volume of trade with the Maghreb (here defined as Algeria, Morocco, and Tunisia), remains modest by comparison with their level of engagement with the Gulf Cooperation Council countries (GCC) or even with Sub-Saharan countries. The latter remain more important to both China and India than the three Maghreb nations. To give one example, in 1992, 31.3 % of China’s imports from Africa came from the Maghreb. By 2018, however, that amount had dropped to 7.76 % because China’s trade with Africa had grown (1). Moreover, while China remains a major source of imports for the three countries, it is not a major export market. Pre-Covid, China was Algeria’s and Morocco’s 11th biggest trading partner for exports while it ranked 15th for Tunisia (2). Although Indo- Moroccan trade is more substantial, India never features within the top ten export destinations for Tunisia or Algeria.

Yet both China and India recognise the significance of the three Maghreb nations as the gateway to the Mediterranean and a market of no less than 95 million people. For now, the locus of engagement of the two Asian giants has mainly been the economic sphere, where both countries face serious competition from a historical partner: the European Union (EU).

Although some analysts and policymakers are concerned about China’s involvement in the Maghreb, the EU remains far ahead of both China and India in trade and its influence extends beyond the economic sphere. The EU, which signed Association Agreements with Tunisia in 1995, with Morocco in 1996 and with Algeria in 2002, which entered into force in 1998, 2000 and 2005 respectively, remains the most important partner for the three nations, which are also part of the European Neighbourhood Policy (ENP).

The first section of this Brief shows how China’s and India’s footprint in the Maghreb is primarily economic. China specifically, in contrast to Russia’s hard power posture in the region, favours a soft power strategy based mostly on economic relationships. While China undoubtedly would like to see Western influence diminished in the Maghreb, it is unlikely that it wants to take over and become a hegemonic power (3). The second and third sections show how the Sino-Maghreb and Indo-Maghreb relationship delivers economic dividends mainly for the two Asian nations, and how their footprint in the region remains light in comparison to the EU. Finally, the Brief concludes with concrete policy considerations for the EU.

China's and India's economic footprint in the Maghreb

In its interaction with the region, China highlights its shared history of resistance to colonialism and imperialism. China’s anti-hegemonic rhetoric regularly alludes to the peaceful ties between China and its Maghreb allies. Similarly, India, which supported the independence movements in Algeria, Tunisia and Morocco, emphasises shared historical experiences based on policies it adopted in the 1950s, namely pro-Arabism, anti-colonial principles and non-aligned values.

The pattern of bilateral trade does not reflect a South- South cooperation approach but rather a dependent trade relationship.

The fact that China and India do not attach strings or conditions to their economic dealings has made them attractive partners for the three nations, which decided in the early 2000s to strengthen links with the two Asian powers. As a result, trade between the two Asian giants and the Maghreb has grown strongly since then. India and especially China wish to expand and strengthen their footprint in the Maghreb and Africa, as the region constitutes an important source of political support for both in international forums, as well as a potentially lucrative new export destination and supplier of oil and minerals.

Data: European Commission, GISCO, 2023; World Bank, The Container Port Performance Index 2021, 2022

In Algeria, Morocco and Tunisia, imports of Chinese products increased significantly from 2003, two years after China joined the World Trade Organization (WTO). This was particularly the case in Algeria, the biggest economy among the three, with which China shared long-standing relations, dating back to Algeria’s anti-colonial struggle against the French. China was the first non-Arab nation to recognise the National Liberation Front (FLN) and Algeria’s provisional government (GPRA) in 1958. In 2014, China signed a Comprehensive Strategic Partnership (CSP) with Algeria. The CSP entails a greater degree of institutional interaction, such as regular meetings between the top leaders of the two countries. The same year, China overtook France as the biggest source of Algerian imports, accounting for more than 14 % of all imported goods. Since then, China has remained Algeria’s principal trade partner (4). Bilateral trade increased from USD 1.6 billion in 2005 to USD 9.5 billion in 2021, making Algeria China’s biggest commercial partner in the Maghreb (5).

China signed a Strategic Partnership with neighbouring Morocco in 2016 and bilateral trade has grown over the past two decades, from USD1.3 billion in 2005 to USD 7.2 billion in 2021. More than 80 Chinese investment projects are currently underway in Morocco (6). In contrast, Sino-Tunisian relations are the least developed in the Maghreb. This is due mainly to an unsettled political environment and to Tunisia’s poor connectivity and infrastructure. Although trade relations have evolved, they remain marginal. Tunisia represents only 0.06 % of total Chinese exports while imports of Tunisian products represent just 0.01 % of China’s total imports. (7)

Trade between India and the Maghreb countries has also increased over the past two decades but progress has not been as spectacular as with China and volumes remain lower since India arrived on the scene a bit later, but also because of the differing sizes of the two countries’ economies. Tunisia’s bilateral trade with India remains, as with China, the weakest by comparison with its neighbours. It stood at USD 201 million in 2005 against USD 594 million in 2021. Indo-Algerian trade grew to USD 1.5 billion in 2021, against USD 470 million in 2005 (8). India’s trade with Morocco showed the most spectacular growth compared to the two other countries, as it increased from USD 660 million in 2005 to USD 3.1 billion in 2021 (9).

In general, the trade balance in the Indo-Maghreb relationship is more equitably distributed than in its Sino-Maghreb counterpart. For instance, Morocco has a trade surplus with India because the latter has become a major importer of phosphates and Morocco possesses the largest phosphate reserves in the world. India exported USD 962 million worth of goods and services in 2022 and imported USD 2.2 billion from Morocco in 2022 (10). The same year, Indian exports to Algeria amounted to USD 517 million and imports from Algeria stood at USD 445 million. (11) Similarly, Indian exports to Tunisia amounted to USD 446 million and imports from Tunisia stood at USD 235 million in 2022 (12).

Compared to Indian imports, however, Maghrebi exports are not very diversified. Algeria almost exclusively exports heavy fuel oils and crude petroleum, whereas Indian exports to Algeria span a diverse range of products including rice, engineering goods, pharmaceuticals and granite (13). Morocco imports a variety of commodities from India including cotton yarn, synthetic fibres, chemicals, machinery, transport equipment, medicines, automobile components and spices, while it primarily exports phosphoric acid, phosphate and metallic ores to India (14). From Tunisia, as with Morocco, India imports phosphates which are vital to its fertiliser industry. India accounts for over 50 % of Tunisia’s global phosphoric acid exports. Conversely, India exports a wide range of products to Tunisia such as mobile telephones, earth-moving heavy equipment for construction, machinery, marine products, sugar, tea, raw tobacco and finished leather (15).

Beijing’s Belt and Road Initiative (BRI) launched in 2013 is intended to strengthen commercial relations between Asia, Europe and Africa. China’s strategy is now to expand the BRI into the Maghreb, the entry point to Africa, via the construction of ports, railways, airports and industrial cities. The construction of commercial transit routes would better enable the shipment of goods from the Suez Canal to the shores of the Maghreb.

Chinese businesses have won a large number of public building and infrastructure contracts in Morocco and Algeria over the past two decades. Morocco became the first Maghreb nation to sign a Memorandum of Understanding (MoU) on China’s BRI in November 2017, followed by Tunisia and Algeria in September 2018. Within the BRI framework, cooperation was upgraded between Morocco and China in 2022 and an agreement for the construction of the Mohammed VI Tangier Tech City, in which Chinese companies own a stake of 35 %, was signed. Chinese developers, including Beijing Zhonglu Urban Development Corporation, the China Communications Construction Company (CCCC) and China Road and Bridge Corporation will build the city on a site of 2 000 hectares. This ‘smart city’ will be completed by 2027 and aims to strengthen Morocco’s linkages within the Euro-Mediterranean region. The Chinese company Huawei is involved in this project as well and more broadly in the kingdom’s communication system. However, while Huawei’s involvement will assist Morocco in enhancing its digital infrastructure, the long-term ramifications pose significant threats in terms of cyber espionage, bulk data collection, and political leverage that must not be overlooked (16).

In Algeria, as early as the mid-2000s, before the BRI, major infrastructure projects were allocated to Chinese public contractors as part of successive government development plans. Among the big contracts was the 2007 East-West highway project, constructed by Chinese and Japanese consortiums. Additionally, there were low-cost housing projects (since 2000, some 250,000 units have been built) (17) and the new terminal at Houari Boumediene Airport in Algiers. The China State Construction & Engineering Corporation (CSCEC) was also awarded several contracts, including for building the Grand Mosque of Algiers, the biggest mosque in Africa. Some state-level investment programmes have a strategic dimension, covering critical infrastructures such as ports; but it remains to be seen whether these projects will ever see the light. Such is the case with the El Hamadania port megaproject in Algeria which is partly financed by Exim Bank of China. Construction of the port was scheduled to start in 2016 but since then nothing has happened.

While relations with Tunisia are minimal, some major infrastructure projects have been realised. Notable examples include the university hospital in Sfax inaugurated in 2020 and the modernisation of the Medjerda-Cap Bon canal in the northeast of Tunisia. The canal, which was built by the Chinese in the early 1980s and dubbed the ‘Tunisia-China Friendship Canal’, was revamped to allow the annual transport of 470 million cubic metres (bcm) of water from the largest dams in the north of the country. Also worth mentioning are the construction of the head office of the national archives, five hospitals in the northwest of the country and the more recent Diplomatic Academy, the result of a Chinese donation of €21 million, intended to showcase China’s burgeoning soft power in Tunisia.

In contrast to China, whose state-owned enterprises (SOEs) are prominent players in the region, public but also private Indian companies are involved in the Maghreb. Indian private companies are the principal agents of India’s commercial strategy in the Maghreb. Indian companies are involved in the construction sector in the three Maghreb nations, even if they are less dominant than their Chinese counterparts. Several public and private Indian companies operate in Algeria, such as IRCON International Ltd, which is executing a railway construction project for the Algerian railway company ANESRIF. Dodsal Engineering and Construction FZE are completing a gas pipeline for the state-owned Algerian oil and gas company Sonatrach while Larsen & Toubro Ltd is developing a gas plant for Sonatrach.

Similarly, several Indian companies are present in Morocco. In the energy sector, several joint ventures exist, as is the case with the Indo Maroc Phospore SA (IMACID), a joint venture between Birla-Tata and the Cherifien Office of Phosphates (OCP) (18). Samta Group is the most recent company to enter the country’s mining sector (19). In addition to phosphates and mining, Indian companies like Bharat Forge and KEC International are present in the heavy equipment manufacturing sector. Finally, Tata Motors and Mahindra are gradually gaining market share in the local automobile industry while the Indian IT giant HCL has recently signed an agreement with the government to invest in Morocco’s outsourcing sector (20).

Indian companies are also present in Tunisia, but their presence remains more marginal than in the two other countries. KEC International and Jyoti Structures Ltd have installed electric transmission lines in Tunisia. Virginia Tech WABAG, an Indian multinational corporation, has been awarded the contract to construct the Zarat Desalination Plant in the southern region of Gabes. In the energy sector, Tunisia-India Fertilisers SA (TIFERT), a joint venture in which two Indian companies, Coromandel Fertilizers Ltd and Gujarat State Fertilizers Ltd have a 30 % stake, has been producing phosphoric acid since 2013 (21).

A win-win relationship?

As seen above, bilateral trade between the two Asian powers and the Maghreb has grown extensively. However, the pattern of bilateral trade does not reflect a South-South cooperation approach as proclaimed by the two Asian partners but rather a dependent trade relationship more typical of trade between developed and developing nations. In the Maghreb, India exports a diverse array of products ranging from manufactured goods to pharmaceuticals and cars while almost exclusively importing raw materials: phosphates from Morocco and Tunisia and hydrocarbons from Algeria. China too is a major exporter of manufactured consumer goods to all three countries while importing little aside from natural resources and fuels (primarily from Algeria).

It is clear that Sino-Maghreb trade is more beneficial for China: despite the latter promising ‘win-win’ economic development, the promise has yet to materialise. First, the trade balance in the three countries is in China’s favour. In 2021, Algeria exported USD 1.1 billion of goods, of which USD 971 million were hydrocarbons (22), and imported eight times that amount. In both Morocco and Tunisia imports from China also heavily outweigh exports. It should be noted that the three countries’ primary export destinations remain European countries, respectively France, Italy and Spain.

Second, although the Maghreb economies are among the most important on the African continent, they remain minor trading partners for China and India. Despite a significant increase in foreign direct investment (FDI) over the past ten years, the Maghreb does not appear to be a priority for Chinese or Indian investors. Chinese FDI in Maghreb countries remains at modest levels. In Morocco, the Chinese invested just USD 350 million in 2020, (23) a drop in the ocean next to European investments. By comparison, France’s FDI in Morocco alone accounted for USD 20 billion in 2020, representing a share of 31 % and making France Morocco’s principal investor. Similarly, Spain’s FDI in the kingdom accounted for USD 5.6 billion, a share of 8.2 %. France and Spain hold 39.2 % of the kingdom’s total FDI stock (24). Likewise, in Tunisia, where China’s FDI amounted to USD 33 million in 2020, European countries are leading investors, with France in the lead with €156.2 million, followed by Italy, Luxembourg and Germany, accounting for a combined total of USD 290 million (25).

Data: Observatory of Economic Complexity, 2023

With India, the situation is similar. None of the three Maghreb countries rank among the top ten countries for Indian investments. Total Indian FDI in the Maghreb is extremely limited, representing less than 4 %. In Morocco, Indian FDI is consistently low and dwarfed by major European states (France, Spain, Netherlands and Germany), the United States and the United Arab Emirates (UAE). In 2021, India invested USD 12 million representing 0.35 % of all FDI in Morocco, a drop from USD 15 million the previous year. These figures mean that India ranks far down the list of countries investing in Morocco, lagging behind much smaller countries such as Ireland, Malta and South Africa (26). The situation is similar in Tunisia, where in 2022 India’s FDI represented just 0.3 % (27), far behind France (35.9 %), Qatar (16.9 %), Italy (13.5 %) and Germany (12.7 %) (28).

A small but growing footprint

China’s and India’s presence in the Maghreb is first and foremost in the economic domain and even there their footprint is less salient than the EU’s. For instance, in Algeria, in the construction sector, where China used to dominate, the Asian behemoth has been awarded fewer contracts in recent years. While it can be assumed that this is due to the pandemic and a sluggish world economy, it is safe to say that this is also due to various scandals that have tarnished the reputation of Chinese businesses in the region in general, (29), especially in Algeria. One of the biggest scandals took place in 2016, when the China Railway Construction Corporation (CRCC) issued cheques to subsidiary companies that bounced and it was alleged that Chinese companies were withholding almost USD 4.2 million in salaries (30). In addition, there was the East-West highway scandal, in which segments of the highway had to be closed only weeks after its opening because they required immediate maintenance. Besides, China now faces competition from Türkiye, which is becoming an increasingly prominent player in Algeria. Turkish construction groups such as Ozgur San, Doruk Construction and Atlas Group are involved in constructing social housing units in different regions of the country. Türkiye is also present in the steel, food, textiles and energy sectors. In 2022, over 1 400 Turkish companies operated in Algeria, employing over 30 000 people.

Furthermore, doubts have been cast on the commitment of Chinese companies to create local employment or foster shared economic development. Hence, when the USD 1.1 billion contract for the Algiers Mosque was signed in 2011, Algeria and China agreed that 10 000 of the 17 000 jobs created would be earmarked for Algerians. Reportedly, however, there were at least 10 000 Chinese labourers on-site when construction began. This creates local resentment against Chinese workers and a backlash against their products.

Data: International Monetary Fund, IMF Data, 2023

Similarly, in both Morocco and Tunisia where craftsmanship is a source of livelihood for thousands of families, ‘made in China’ copies of local artefacts are eclipsing traditional crafts in the region and endangering thousands of jobs. In Tunisia for instance, local craftsmen are angry and worried about the negative impact of cheap Chinese products on traditional handmade crafts. According to official statistics, China tops the list of countries contributing to the trade balance deficit, accounting for more than 30 % of the general deficit (31).

As a consequence of growing ties, it might be expected that there would be more Chinese migrants in the Maghreb countries but this is not the case. Even in Algeria, the country in Africa with the most Chinese workers in 2016, their numbers have been dwindling since 2019. There were 14 515 Chinese nationals resident in Algeria in 2002, 49 631 in 2009 and 91 596 in 2016 (32). However, in 2020, only 18 078 Chinese workers remained in the country, slightly more than in 2002 when Sino-Algerian relations were still in their nascent phase. This might be due to the pandemic, or because workers moved to Africa due to Beijing’s foray into the continent, yet if these workers were settled in the country and integrated into the social fabric, as is often proclaimed on Chinese state media, one might expect more to stay and not leave in such numbers. Likewise, there were fewer than 500 Chinese workers in Morocco in 2020 against 1 311 a decade earlier. (33) Equally, there were only 162 Chinese workers in Tunisia in 2020, compared to 650 in 2013 (34).

In terms of Chinese cultural programmes, there are just four Confucius Institutes in the Maghreb (none in Algeria), as opposed to 61 across the African continent (35). The Chinese embassy has increased its public diplomacy and social media presence in the region, especially in Tunisia. China’s media footprint is more visible than in previous years, yet remains small. For instance, the Chinese embassy in Tunisia and the Confucius Institute at the University of Carthage co-organised in June 2022 a Chinese proficiency competition, called ‘One World, One Family’ (36). The embassy has expanded its outreach to individual journalists, media executives and local newspaper editors’ organisations. Tunisian journalists have participated in a Belt and Road News Network-sponsored media training programme and were offered opportunities to travel to China. Similarly, in 2019, Chinese official media outlets reached a deal to broadcast programmes on Tunisian public television during what has become an annual ‘China Television Week’, showcasing China’s economic dynamism and culture (37).

China possesses little soft power in Algeria, Tunisia and Morocco compared to Europe or even Türkiye, and its cultural influence is limited. If we compare the number of students from the Maghreb in China to those still electing to study in Europe, it is clear that the cultural connections and attachments to Europe remain strong. The number of Maghrebi students studying in China has grown but remains quite insignificant compared to students from the rest of Africa in China or Maghrebi students in Europe. In 2019, there were roughly 20 000 ‘Arab’ students in China. Among these, the biggest groups were Sudanese, followed by Egyptians and Syrians, with Tunisians only coming in fourth position, followed by Moroccans in fifth position and then Algerians in eighth position (38). By comparison, in 2018 students from the rest of Africa in China represented 16.5 % of the total, corresponding to about 500 000 students in China. Ghana, Nigeria, Tanzania and Zimbabwe were among the top five African countries with the highest numbers of students studying in China (39).

In contrast, Europe remains the preferred destination for cultural exchange and university studies. France alone hosts the lion’s share of Maghrebi students abroad. In 2022, Moroccan students were by far the biggest group of all international students in France with 44 933 students. Algerian students followed in second position with 29 333 (8 % of the total students) while there were a total of 13 152 Tunisian students (4 % ) (40). In addition, Morocco and Tunisia are part of Erasmus+ which creates mobility opportunities for over 15,000 students every year.

Moreover, tourism remains limited between the Maghreb and China. Algeria is still a difficult destination for Chinese tourists as the visa procedures are tedious. An agreement on efforts to promote tourism was signed in December 2022 (41). Tunisia has seen a rise in Chinese tourism following the liberalisation of visa policies in 2016. The number of Chinese tourists increased from 2 000 in 2016 to 18 935 arrivals in 2019 (42), but this constitutes an insignificant proportion of the 9.4 million tourists that visited Tunisia the same year (2.7 million were Algerians) (43). As for Morocco, the country saw a 46 % increase in tourism from China following the liberalisation of visa rules in 2016 and some 132 000 Chinese tourists visited the kingdom in 2018, compared to only 10 000 three years earlier (44). Yet, this represents a fraction of the 13 million tourists who visited the country in the same year, half of whom were Moroccans from the diaspora, followed by French and Spanish visitors (45).

In terms of the respective number of workers in the Maghreb, there are far more Chinese workers in the three nations than Indian workers: the latter can be counted in dozens rather than hundreds. Overall the number of Indians living in the Maghreb is insignificant. The resident Indian community in Tunisia is comprised of a few families, totalling around 50 people (46), against 600 in Morocco (47) and less than 4 000 in Algeria, with a high number of semiskilled labourers employed as bricklayers, carpenters, painters and welders (48). Cultural cooperation is also limited to yearly events such as the International day of Yoga (IDY) celebration or film festivals where Hindi movies are screened.

A strategically important region for the EU

As seen above, China’s and India’s presence in Algeria, Morocco and Tunisia is above all economic, and their political or security influence remains very limited for now. China’s (and a lesser extent, India’s) investments in the Maghreb have raised some issues, chief among them concerns that China is operating a policy of ‘debt trap diplomacy’. In Africa for instance, Beijing has already exerted pressure on several indebted African nations (e.g. Kenya and Burkina Faso). The three Maghreb nations are not (yet) under pressure since they have not borrowed as much as their African neighbours and China lacks comparable influence in the region; yet they should be wary of suffering the same fate as other countries that have become entangled in Chinese debt.

The EU has a card to play at several levels. On the investment side, the EU should consider complementing, not challenging, Chinese and Indian investments. The best option for European companies would be to move away from industries where their competitiveness is at risk, including the construction and public works sectors, and to move into more robust value-added service industries such as agribusiness, insurance, mass distribution and green energies where their expertise is solid and their reputation well-established. The potential for developing solar and wind power is considerable in green energies. Solar yields are three times greater in the Maghreb than in Europe and the wind power potential is also very high. The Green Partnership signed with Morocco in October 2022 is a good start, but the EU should actively pursue similar partnerships with Algeria and Tunisia. (49)

On the economic level, the EU could also encourage better regional integration. In 2019, trade between North African countries (Mauritania, Morocco, Algeria, Tunisia and Libya) stood at 2.8 % of the bloc’s total, compared to 57.4 % with the rest of Africa and 97.2 % with the rest of the world. The Maghreb underperforms compared to the GCC (10.7 %) (50). This low level of intraregional trade is partly due to the Western Sahara dispute between Algeria and Morocco.

Besides, institutionally, the Maghreb countries have solid state, administrative and public service structures, despite some challenges in the areas of efficiency and transparency. This institutional framework is crucial and should contribute to fostering a more fruitful dialogue.

The EU must find a better way to interact with the partner. Europe needs a shared Euro-Mediterranean space to unite its population with those of countries to the south and east of the Mediterranean. Both sides would benefit from a greater Europe-Mediterranean-Africa region, integrating a space that by 2050 will include more than two billion Africans. Along this axis, the Maghreb occupies a crucial strategic position.

The relationship with the Maghreb must be cultivated if the EU wants to remain relevant in the region. As Europe remains preoccupied with the war in Ukraine, it should not turn inward at the expense of engagement with its southern neighbours, particularly in the Maghreb, with which it has long-standing ties and where it still has a crucial role to play.

References

* The author would like to thank Caspar Hobhouse, EUISS trainee, for his research assistance.

1. World Integrated Trade Solution, ‘China imports by country and region, 1992-2018’ (https://wits.worldbank.org/CountryProfile/en/Country/CHN/ StartYear/1992/EndYear/2018/TradeFlow/Import/Partner/ALL/Indicator/ MPRT-TRD-VL#).

2. ChinaMED data, ‘Algeria’, 2021 (https://www.chinamed.it/chinamed- data/north-africa/algeria).

3. Chatham House, ‘Expanding Sino-Maghreb relations’, February 2020 (https://www.chathamhouse.org/2020/02/expanding-sino-maghreb- relations).

4. Anadolu Agency, ‘Algeria, China sign 5-year strategic cooperation’, 8 February 2022 (https://www.aa.com.tr/en/politics/algeria-china-sign- 5-year-strategic-cooperation-pact/2732689).

5. Trading Economics, ‘Algeria Imports from China’ (https:// tradingeconomics.com/algeria/imports/china).

6. ‘Le maroc acteur clé pour la Chine au Maghreb’, Le Point, 6 January 2022 (https://www.lepoint.fr/afrique/le-maroc-acteur-cle-pour-la-chine- au-maghreb-06-01-2022-2459428_3826.php).

7. OEC, ‘China-Tunisia’, Bilateral trade profile, 2005-2020 (https://oec. world/en/profile/bilateral-country/chn/partner/tun?dynamicBilateralTra deSelector=year2016).

8. Embassy of India, Algiers, ‘India-Algeria relations’, 2023 (https://www. indianembassyalgiers.gov.in/page/india-algeria-relations/).

9. Embassy of India, Tunis, ‘India-Tunisia relations’, 2023 (https://www.embassyofindiatunis.gov.in/india-tunisia-bilateral-relations.php).

10. Embassy of India, Rabat, ‘India-Morocco bilateral relations’, 2023 (https://mea.gov.in/Portal/ForeignRelation/Bilateral_brief-31July_2022. pdf).

11. Embassy of India, ‘India-Algeria relations’, op.cit.

12. Embassy of India, ‘India-Tunisia relations’, op.cit.; ‘India-Morocco bilateral relations’, op.cit.

13. Embassy of India, ‘India-Algeria relations’, op.cit.

14. Embassy of India, ‘India-Morocco bilateral relations’, op.cit.

15. Embassy of India, ‘India-Tunisia relations’, op.cit.

16. Neary, B., ‘China’s Digital Silk Road in Morocco: The implications of digital sector dominance’, MIPA, 27 February 2023 (https://mipa. institute/en/9178). The 2009 Huawei Marine Networks project linking Tunisia to Italy has raised similar questions on cybersecurity and data collection.

17. Souiah, F., ‘L’Algérie made by China’, Méditerranée, 2011 (https:// journals.openedition.org/mediterranee/5468).

18. Chambal Fertilisers ‘Joint Venture – Indo Maroc Phosphore SA (IMACID)’, 2023 (https://www.chambalfertilisers.com/index7ad5.html).

19. Morocco World News, ‘Samta mining to invest 100 million, leads Indian business to Morocco’, 9 December 2021 (https://www.moroccoworldnews.com/2021/12/345928/samta-mining-to-invest-100- million-leads-indian-business-to-morocco).

20. Morocco World News, ‘India’s HCL, Morocco sign agreement to invest in outsourcing’, 30 May 2022 (https://www.moroccoworldnews. com/2022/05/349384/indias-hcl-morocco-sign-agreement-to-invest- in-outsourcing).

21. Embassy of India, ‘India-Tunisia relations’, op.cit.

22. ChinaMED data, ‘Algeria’, op.cit.

23. ChinaMED data, ‘Morocco’, 2021 (https://www.chinamed.it/chinamed- data/north-africa/morocco).

24. ‘Maroc: la France chef de file des IDE (66 milliards de dollars)’, Financial Afrik, 23 October 2021 (https://www.financialafrik.com/2021/10/23/ maroc-la-france-chef-de-file-des-ide-66-milliards-de-dollars/).

25. Lyttle, C., ‘What role do French colonial legacies play in African FDI?’, Investment Monitor, 29 June 2022 (https://www.investmentmonitor.ai/ features/french-colonial-fdi-africa-morocco-tunisia-cote-divoire/).

26. Office des Changes du Maroc, ‘IDE par pays’, 2022 (https:// www.oc.gov.ma/fr/etudes-et-statistiques/series- statistiques#collapseCollapsible1673523522915).

27. Invest in Tunisia, ‘Bilan des flux IDE’, 2022 (http://www.investintunisia. tn/Fr/publications_21_196_D11#.Y9e--3bMI2x).

28. Standard Bank, ‘FDI in Tunisia’, 2023 (https://www.tradeclub. standardbank.com/portal/en/market-potential/tunisia/investment).

29. Feng, E., ‘China’s global construction boom puts spotlight on questionable labor practices’, National Public Radio, 30 March 2019 (https://www.npr.org/2019/03/30/707949897/chinas-global-construction-boom-puts-spotlight-on-questionable-labor-practices).

30. Ghanem, D. and Benabdallah, L., ‘The China Syndrome’, Carnegie, 18 November 2016 (https://carnegie-mec.org/diwan/66145).

31. France 24 Arabic, ‘Chinese counterfeit products threaten the handicraft sector’, [in Arabic], 14 February 2023 (https://bit.ly/3SWTnyw).

32. ChinaMED data, ‘Algeria’, op.cit.

33. ChinaMED data, ‘Morocco’, op.cit.

34. ChinaMED data, ‘Tunisia’, 2021 (https://www.chinamed.it/chinamed- data/north-africa/tunisia).

35. CGTN, ‘Confucius Institutes a bedrock of growing cultural ties with Africa’, 22 August 2018 (https://news.cgtn.com/news/3d3d514f346b544e 79457a6333566d54/share_p.html).

36. Xinhua, ‘China’s growing global influence attracts more Tunisians to learn Chinese’, 10 June 2022 (https://english.news.cn/20220610/82936b7 bcee74ad390fab149fdcd8d5a/c.html).

37. Freedom House, ‘Tunisia’, 2022 (https://freedomhouse.org/country/tunisia/beijings-global-media-influence/2022#footnote1_dyuc4j7).

38. Al Fanar Media, ‘Arab students in China are trapped by Corona outbreak’, [in Arabic], 6 February 2020 (https://al-fanarmedia.org/ar/ar/2020/02/ بالطلا-برعلا-يف-نيصلا-نورصاحم-ببسب-شفت/).

39. University World News, ‘Educational superhighways from Africa to China speeds up mobility’, 19 November 2020 (https://www. universityworldnews.com/post.php?story=20201118132655210).

40. ‘Etudiants étrangers en France: Les Marocains toujours en tête’, Aujourd’hui le Maroc, 22 July 2022 (https://aujourdhui.ma/societe/ etudiants-etrangers-en-france-les-marocains-toujours-en-tete-2).

41. Xinhua, ‘Algeria, China sign key area cooperation plan’, 9 December 2022 (https://en.imsilkroad.com/p/331611.html).

42. Kapitalis, ‘Tunisie : le nombre de touristes Chinois progresse’, 21 August 2019 (http://kapitalis.com/tunisie/2019/08/21/tunisie-le-nombre-de- touristes-chinois-progresse-de-10-au-10-aout-2019/).

43. Echorouk online, ‘2.7 million Algerians visited Tunisia since the beginning of 2019’, 30 December 2019 (https://www.echoroukonline. com/2-7-million-algerians-visited-tunisia-since-the-begining-of-2019).

44. ‘Le Maroc veut devenir une destination de choix pour les touristes chinois’, Jeune Afrique, 12 September 2019 (https://www.jeuneafrique. com/828449/economie/le-maroc-veut-devenir-une-destination-de- choix-pour-les-touristes-chinois/).

45. H24, ‘2019 année record pour le tourisme au Maroc avec 13 millions de visiteurs’, 5 February 2020 (https://www.h24info.ma/economie/2019- annee-record-pour-le-tourisme-au-maroc-avec-13-millions-de- visiteurs/).

46. Embassy of India, ‘India-Tunisia relations’, op.cit.

47. Embassy of India, ‘India-Morocco bilateral relations’, op.cit.

48. Embassy of India, ‘India-Algeria relations’, 2023, op.cit.

49. European Commission Press Team, ‘EU-Morocco Green Partnership’ 25 October 2022 (https://ec.europa.eu/commission/presscorner/detail/en/ ip_22_6362).

50. Abouzzohour, Y., ‘Inter-regional integration would boost Maghreb economies’, 4 March 2021 (https://www.brookings.edu/opinions/ bdc-snapshots-intra-regional-economic-integration-would-boost- maghreb-economies/).