The energy sector is by default cyclical and history provides abundant examples of market expansion followed by sudden and at times painful contraction. Alas, the current crisis differs from previous such episodes in several important respects, mainly because the recent surge in energy prices offers a glimpse of a future where a transition to a low-carbon economy that is not properly managed or stress-tested against scarcity and volatility might produce recurrent market crunches and hinder the decarbonisation trajectory (1).

A confluence of interconnected factors has created turmoil in the energy market. In hindsight, it seems that the economy might have been better prepared to withstand the shock if the EU had conducted horizon scanning and worst-case scenario resilience exercises that could have anticipated such disruption. Ultimately, policies focusing exclusively on emissions reduction have compounded the situation. As the winter season sets in, soaring prices heighten inflationary pressures, constrain post-Covid recovery objectives and exacerbate the energy poverty predicament of millions of Europeans.

The balance between the three dimensions of the energy trilemma – security, affordability and sustainability – has come under strain, to the consternation of consumers. If not managed effectively, the crisis can compromise the pursuit of the overarching net-zero emissions target, and feed into emerging anti-transition sentiment that could sabotage support for the flagship European Green Deal (EGD) and undermine the EU’s global climate leadership. This makes the design and deployment of targeted and anticipatory mechanisms to cope with the volatility of the energy market all the more imperative.

This Brief explores the causes of the crisis, analyses its impacts and proposes strategic responses in the short, medium and long term to bolster the EU’s systemic resilience to energy market volatility in a context of radical decarbonisation. The overriding premise of the Brief is that the EU’s ability to transition to a carbon neutral economy while navigating the accompanying challenges and instability will foreshadow and inform processes across the globe, and predetermine the global net-zero trajectory.

A perfect storm?

Gas supply and demand cycles are impacted by weather and economic activity. The winter season in 2020/21 was unusually cold in both Asia and Europe – the two main competing markets for liquefied natural gas (LNG). Competition was accentuated by severe contraction of supply. Freezing weather in Texas at the beginning of the year led to concern about the resilience of energy infrastructure to extreme weather events, but it also resulted in a reduction of US LNG cargoes usually departing at this period for Asia and Europe to cater for heightened heating demand. The situation further worsened as the year progressed, with summer heatwaves across Europe, Asia and the United States leading to a surge in demand for air conditioning. In Latin America drought-induced reduction in critical hydropower generation caused even more LNG cargoes to be diverted away from Europe. Temporary transit problems in the Panama Canal further complicated matters.

In addition, President Biden’s climate ambitions combined with Wall Street’s emphasis on capital discipline post-Covid have curtailed capital flows in the shale gas sector, constraining the agility of LNG producers in responding to the surge in international gas hub prices. Scarcity of shipping capacity triggered by the pandemic pushed LNG spot shipping rates to an all-time peak of $200,000 at the beginning of 2021, compounding the high price environment (2).

Simultaneously, the deployment of economic stimulus packages spurred swift economic recovery and increased power demand from industry, attracting LNG cargoes to the economies that had been the first to recover from the effects of the pandemic – China becoming the largest LNG importer at the beginning of 2021 (3). International Energy Agency (IEA) data shows that in the EU, in the second quarter of 2021, gas consumption rose by 25 % (the largest year-on-year quarterly increase since 1985) (4). The increased competition for scarce resources led to surging benchmark prices in line with free market economics dictums.

Reduced shares of wind power in electricity generation have amplified demand for gas and coal.

Internally, the EU has seen wind generation severely constrained due to suboptimal wind conditions. Large parts of the northern European energy market, in particular Germany and the Netherlands, rely on wind generation for as much as one fifth of power supply. Reduced shares of wind power in electricity generation have amplified demand for gas and coal. The phasing-out of nuclear power in Germany has exacerbated the tightness in the energy market. This might be an omen for a future energy system where renewable curtailment due to suboptimal conditions cannot be offset by large-scale batteries and/or sufficient baseload power supply. Domestic gas resources in the Groningen gas field are also dwindling with the field set for closure in 2022. Moreover, gas storage has reached historically low levels. The drawdown on stocks to satisfy power demand for first heating and then air conditioning was followed by an insufficient injection of new inventories leading to systemically low replenishment levels throughout 2021. Stocks held in May 2021 were about 30 billion cubic metres (bcm) compared to about 90 bcm in 2020 and an EU storage capacity of about 117 bcm (5). Storage inventories were at around 55% of capacity in December (6). The depleted reserve is a critical contributing factor to the current crisis.

The rate of replenishment is a key indicator regarding the short-term (Winter 2021-22) and long-term resilience of the energy system to market tightness and extreme prices. The low inventory levels mean that Europe will not be cushioned against protracted market fluctuations. Some analysts surmise that EU storage levels will not return to historic averages before next winter, contributing to a sense of foreboding both among the industrial and household consumers (7).

As more LNG export terminals come online in the United States in the wake of Covid-19 and weather-prompted closures, it will be easier to gauge the availability of LNG cargoes to alleviate the demand in the EU. Strategic discussions with US LNG exporters for priority supplies to the EU might be a solution for future supply crunches and excessive competition. These could take place in the context of the upcoming EU-US Energy Council (planned to take place in early February 2022).

Concurrently, while Russia has continued to fulfil its contractual obligations, Gazprom has seemed ‘unable’ or ‘unwilling’ to deliver more (8). The official position of Russia is that wildfires and disruptions caused by Covid-19 curtailed its gas capacity and discretionary supply volumes in 2021. Throughput from the Yamal pipeline at the Mallnow metering point on the German-Polish border plummeted to 49 million cubic metres (mcm)/day (from 81 mcm/day) in July, reaching a nadir of 20 mcm on 11 August after the Novy Urengoy plant fires (9). Gazprom also has the legal obligation to first replenish domestic gas stocks (severely reduced after a cold winter) before releasing supplies elsewhere. While some argue that Russia is trying to pressure the EU on the Nord Stream 2 (NS2) pipeline, current dynamics seem to indicate that irrespective of the transportation route, Russian gas deliveries remain critical to the EU in the short to medium term. However, even if Russia agrees to release additional volumes to Europe, gas storage facilities cannot be replenished instantaneously; therefore, in the event of a cold and protracted winter season, demand will continue to outstrip supply and lead to further escalation of current market tightness dynamics. These conditions will set the stage for high consumer energy bills – both for industry and households – potentially leading to social unrest and closures of manufacturing plants and businesses, a surge in the price of key staples and a competitive disadvantage for EU industry, facing competitors (particularly China) that manage to replenish gas stockpiles more quickly. Lastly, the EU’s ambitious climate agenda and the tightening of the Emissions Trading System (ETS) rules led to a much-awaited rise in carbon prices, reaching an unprecedented peak of €88/tonne recorded on 8 December 2021. High carbon prices translate into a high premium for switching from gas to coal; scarcity and soaring gas prices have prompted utility companies to switch to coal, despite the significant carbon premium, thereby driving both gas and coal prices further up and exerting strong inflationary pressures on the cost of electricity, which under the marginal pricing model in the EU is directly linked to the price of gas (10).

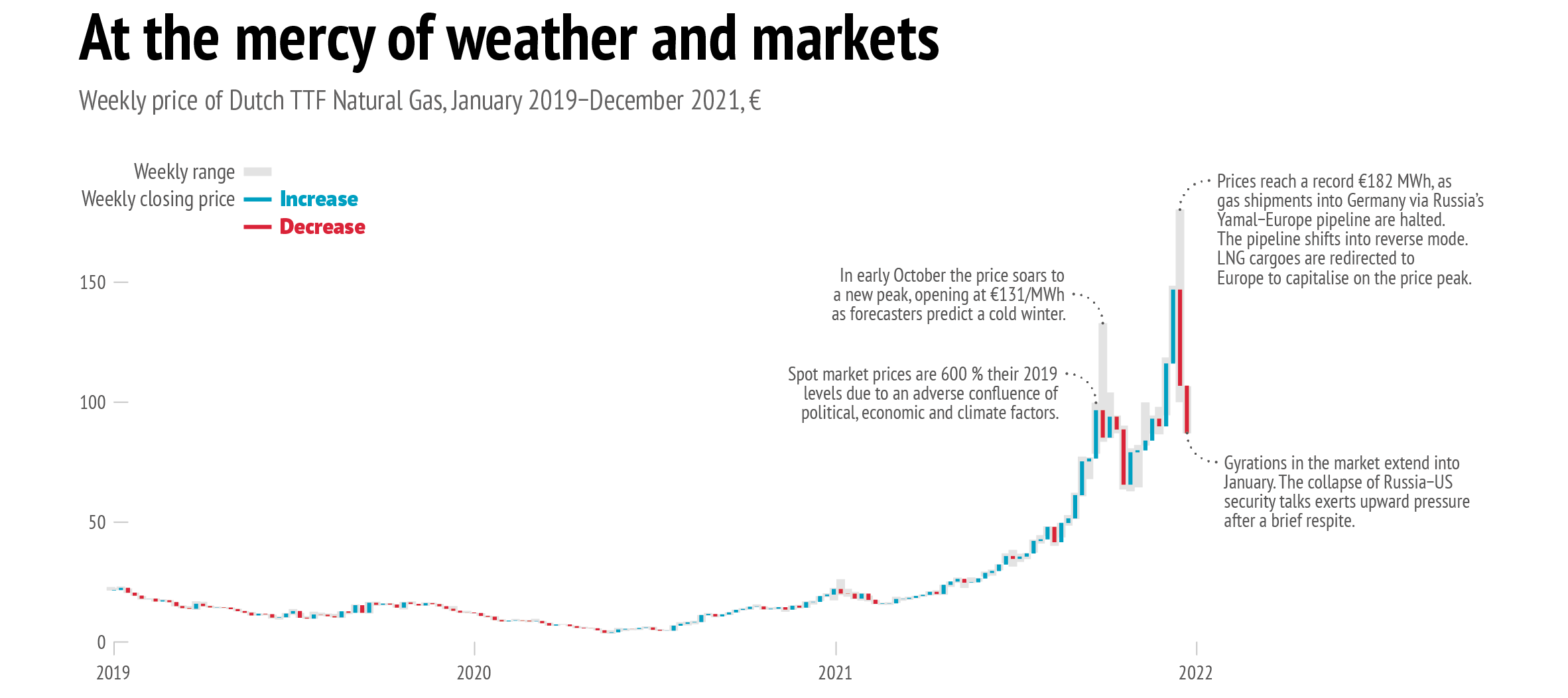

The fallout

Soaring energy prices amplify inflationary pressures and thereby adversely impact the post-Covid recovery curve. The steep 17.4 % rise in inflation in the energy sector in summer 2021 led to a 13-year inflationary peak in the eurozone economies of 3.4% in September 2021, increasing to above 5 % in December (11). The price of natural gas in the European spot market in September 2021 was 6.5 times higher than in 2019 (12). In October, the price soared further as forecasters predicted a cold winter. The daily TTF (the Dutch hub price, a European benchmark) reached a new peak, opening at €131/MWh, creating a historic anomaly of gas prices exceeding oil price levels (13). The main EU competitor for gas resources is Asia; to attract gas cargoes European spot prices have to surpass Asian ones – prices in Asia were about 4 times higher than at the same period in 2019, temporarily reaching $30 million British thermal units (mBtu), thus proving more competitive, and diverting LNG cargoes away from European markets (14). The trend was temporarily reversed on 21 December, when gas prices in Europe hit a record €182 MWh, rerouting LNG tankers already headed to Asia, an unprecedented development (15).

Gas represents 22 % of European electricity generation and, due to the marginal pricing model, the soaring prices were transferred to consumer bills. In 2021 the key benchmark EU power contract for power doubled, and wholesale electricity prices surged to about 7.5 times the value of the 2010-2020 averages (16). The average wholesale gas and electricity price increases from 2019 to 2021 (September) were 429 % and 230 % respectively, according to Commission analysis (17). Day-ahead electricity prices surged to unprecedented levels, with prices exceeding €400/MWh for almost three quarters of Europeans on 21 December (18).

Data: Yahoo Finance, 2022

This has triggered steep price hikes, constrained output and led to escalating prices of energy-intensive industrial products (aluminium prices spiked to a 13-year high at $3,000/metric tonne), protests right across the bloc, and the emergence of uncoordinated palliative measures taken by Member States, often compromising the central dictums of the single energy market (19). This amounts to a Rorschach test for the EGD trajectory and reveals a significant loophole in the current policy prescriptions where the objective to cut gas consumption by one third by 2030 is not supported by a credible gas exit roadmap on how this can be achieved. As current market conditions reveal, this myopic approach may prove untenable and undermine the transition trajectory.

If reliance on public subsidies to cushion the consumer against high prices continues, this will erode budgets and undermine recovery efforts. It will also perpetuate the practice of subsidising fossil fuels, which goes against the grain of the EU’s ambitious decarbonisation strategy. Investors have expressed concern about a stagflation scenario and compromised post-Covid recovery if the trend extends into the first quarter of 2022. A gas price rally becoming an intractable issue in the coming months will fuel self-fulfilling prophecies of high inflation that will jeopardise recovery and decarbonisation efforts (20).

The way forward

Weather is a key factor to be incorporated into analysis of the energy conundrum – if the 2021/22 winter season turns out to be as cold as the previous one in Europe (meteorological models seem to indicate that this will be the case), and in other parts of the world where markets that it competes with for energy resources are located, this might compound the current crunch. The deterioration of the security environment in Europe’s eastern neighbourhood would also exacerbate an already dire situation.

A high-price environment might become the ‘new normal’ as we progress down the pathway of decarbonisation.

Policies should be directed towards designing mechanisms to firstly withstand volatile energy market fluctuations, and secondly, comprehensively stress-test the transition process which is unlikely to be as smooth as policy rhetoric seems to suggest. Price fluctuations (for instance for oil supplies) have traditionally been mitigated via strategic reserves, minimum inventory level requirements and subsidies for low-income households. This approach can be applied to gas markets as well. Other strategies could include amplified demand aggregation and collective gas purchasing, as well as inducing a change in behaviour among consumers and improving energy efficiency. The following ideas might merit consideration as the EU continues to grapple with the fallout from the energy crisis and looks for sustainable solutions to the supply-demand imbalances that are set to accompany the decarbonisation trajectory:

- Automatic collective solidarity measures: Going forward, sustaining market fundamentals is important – but when markets fail to balance supply-demand dynamics, to avoid self-reinforcing volatility and disruption, and the economic damage caused by price spikes, a collective response is necessary within the EU, automatically activating solidarity measures and demand aggregation, as an antidote to the current cacophony of measures (21).

- Demand-side management: Demand-side management is a critical measure that should be deployed on a large scale to curtail non-essential consumption during peak demand. In addition, capacity markets have been extensively used in the past to allow for baseload supply to be activated seamlessly without price externalities – these mechanisms should not be abandoned prematurely. Measurement of effective load-carrying capabilities (the ability to perform at peak stress on the power grid) should be executed to assess resource agility within the power system.

- Gas imports – pipelines: Relations with Russia face a new litmus test – either Russia uses the opportunity to dictate conditions to the EU, or the two overcome antagonistic dynamics and establish a new cooperative relationship (22). Ensuring supply from Russia, ether via existing routes or the NS2, might be essential for an effective medium-term solution to further market fluctuations (23). The current ratcheting up of tensions with Ukraine is concerning and might lead to disruption of supplies to Eastern Europe, a development not without precedent, hence the situation needs to be de-escalated. In view of Alexander Lukashenko’s threat to cut off gas deliveries along the Yamal pipeline if EU sanctions are extended, Russia’s leverage might also help to avoid the rolling blackouts across Europe that such disruption would most certainly generate. Safeguarding Azeri gas flows via the Trans-Adriatic Pipeline is key, as is pushing ahead with the upgrade of the Algerian pipelines, re-opening the Maghreb-Europe gas pipeline and advancing the East-Med pipeline discussions. While reinforcing gas infrastructure might seem at odds with the net-zero emissions vision, the current dynamics clearly demonstrate the continuing importance of gas at least in the medium term. To dispel any worries about gas infrastructure becoming a stranded asset, any new infrastructure development has to ensure support of clean energy carriers such as hydrogen, synthetic gas and bio gas.

- Gas imports – LNG: Looking ahead in a global gas market, no longer constrained by pipelines and geographic proximity, market dynamics will dictate prices, rather than long-term contracts. The EU should carefully prepare for this heightened competition, given the willingness of Asian customers to pay a premium for LNG cargoes. In this context, the EU should seek to negotiate LNG contracts with Israel or Egypt as a priority. In addition, ensuring LNG supplies from the United States but also Russia, would seem prudent. The move away from long-term purchasing agreements pursued by the EU Member States has been revealed as premature by the current circumstances of heightened global demand and in the absence of stable baseload capacities.

- Managing the transition: The energy transition trajectory is critical; it is also, as energy models attest, technologically and financially feasible (24). Radical decarbonisation should therefore be pursued with determination and resolve. Yet, this will take time and effort, beyond what policy prescriptions condition us to expect. A high-price environment might become the ‘new normal’ as we progress down the pathway of decarbonisation. Critical thinking and system proofing are necessary to counterbalance the extreme volatility in the market. The pace of the transition is important – as examples from across the Atlantic show, hurried phasing-out of controversial power generation capacities without ensuring sufficient utility-scale battery storage to compensate for intermittent renewable energy supplies will fuel price volatility, create green scepticism and may lead to power blackouts and even a return to fossil fuels (25). The imperative is not to slow down the momentum of the net-zero transition, because it is vital for societies both within and beyond Europe, but to manage it and avoid it becoming a source of collective frustration, as that would inevitably undermine its objectives. The current crisis clearly demonstrates that Europe has not been preparing for a moment where carbon pricing will finally reach desired levels, and utilities and energy-intensive manufacturers find it too expensive to switch to carbon-intensive sources, and hence opt to either curtail production, roll blackouts or pass the price hike onto households and customers. This shows that carbon price spikes in a curtailed environment with suboptimal renewable energy generation result in uncontrolled energy price inflation. Ultimately, this reveals how a sense of complacency has weakened our vigilance, leading to the crisis with which the EU is now confronted.

- Collective strategic reserve: IEA-affiliated Member States have this as a mandatory requirement for oil stocks, but the EU might impose such a requirement for all its Member States as a minimal percentage of consumption for gas as well. Currently, Member States are responsible for their own gas reserves and gas storage facilities are not equally distributed across the continent. A collective inventory, along the lines of how the IEA coordinates oil strategic stockpiles (both government-owned and company-owned), presents a good blueprint.

- Collective energy crisis fund: Utilising the EU carbon permit revenue budget to alleviate adverse cost pressures is a proposal that merits consideration, because this crisis will likely recur, and the most vulnerable to its impacts are the most fossil fuel-reliant, poorer Member States, thus perpetuating existing divisions as we progress on the net-zero trajectory.

- Energy efficiency: Upscaling efficiency standards for appliances, building and production processes is essential, next to pan-European awareness campaigns aimed at promoting more sustainable lifestyles.

- Flexibility - Power exchange, batteries, hydrogen: Diversifying the origin and route of gas supply has been a key component of the EU’s energy security efforts, but this has to be extended to the new energy system. The Union has committed to enhancing power exchange capacity among Member States but significant progress remains to be achieved. In a system with high levels of intermittency, demand for power system flexibility will dramatically increase (the IEA projects a 4-fold increase). In this context, achieving and exceeding the electricity interconnection target of 15 % by 2030 is imperative. In an electricity grid system mainly powered by renewable energy, deployment of utility-scale batteries and hydrogen production technologies will also curb demand for natural gas and provide the necessary seasonal adjustment to variability in renewable power generation. This will also shield supply from commodity swings and a diverse array of adverse factors (including extreme weather, cyber or physical attacks, conflict and geopolitical instability). In this vein, building ‘hydrogen highways’ between the EU and the MENA region, and construction of the EuroAfrica subsea electricity interconnector, should be pursued as a priority.

- Just energy transition: The current crisis also brings to the fore the reality of a transition process which has deepened existing inequalities across the Union. The energy price surge has disproportionately impacted people who are already considered energy vulnerable. This has exacerbated divisions and inequalities both in societies within Member States and between Member States. These inequalities fuel social discontent and are grist to the mill of populist politicians who peddle anti-transition narratives contributing to market chaos. Eradicating the scourge of energy poverty in one of the world’s most affluent continents will be crucial as the Union embarks on the next phase of its domestic energy transformation and global climate leadership (26). In addition, to maintain public support for the energy transformation, the EU needs to invest more in communicating the rationale for its decarbonisation strategy to citizens, as acknowledging the risks and marshalling public support for the measures taken is essential. This is something that the EU has done at a high level among expert elites in Brussels and across national capitals but not so much beyond. Measures such as capping energy taxes, establishing energy price ceilings, subsidising consumers and redirecting profits from energy companies would benefit from wide stakeholder discussion, to ensure that they are understood, accepted and above all do not run counter to the objectives of the internal Energy Market (IEM) and the green transition by providing indirect support to fossil fuels.

- Energy market reform: Laissez-faire economics cannot and should not apply to energy markets. Free market supply-demand rebalancing dynamics can function in an environment of temporary price fluctuations. In the current situation, characterised by market swings and fluctuations that could potentially become a regular occurrence, scarcity pricing can induce significant economic harm – directly, due to soaring prices, and indirectly, due to investment uncertainty and constraints on household disposable income. Such market failures can compromise the energy transition process and deepen social inequalities. This makes an honest examination of the marginal pricing model, which sets the price in accordance with the last and most expensive unit of energy purchased, an urgent priority.

- Futures analysis: In addition to the above, the Union should develop a horizon scanning system to enhance capacity to anticipate, withstand and recover quickly from a supply shock and/ or wild swings in the energy market. The interconnectedness of markets means that a crunch in one geographical region will reverberate across the world and in the unfortunate event of a ‘perfect storm’ of mutually reinforcing negative forces, like the one which we are currently experiencing, Europe might be left paying the highest price. As mentioned previously, the freezing weather and its impact at the beginning of 2021 in the United States, suboptimal wind velocity in northern Europe, and droughts and hydrological cycle alterations in Latin America should have served as a signal to the EU that supplies might be curtailed. Likewise, economic data from China auguring economic recovery, hence increased demand for energy. It is of paramount importance that such a monitoring and energy security early warning system be put in place. This should also critically include regular exercises simulating renewable energy generation under changing weather conditions, and in-depth analysis of the global terrestrial stilling phenomenon (27), alterations in the Gulf Stream and El Nino, cyber resilience and security, market gyrations across the globe, as well as projecting what mitigating measures should be deployed in different timescales to avoid compromising the stability of the energy system. The ability to conduct such exercises, develop strategic foresight on systemic disruptors and set in place anticipatory mechanisms to tackle them quickly and efficiently will define energy security and energy system resilience in the net-zero age. The current energy price crisis was perhaps not so easy to predict, but could easily have been simulated as part of an energy security planning exercise of the type proposed above. Such exercises need to be institutionalised to sustain and shield the energy transition going forward.

- Oil market tightness: The experience with gas should not overshadow tightness in oil markets, which seems not to have garnered a lot of attention. Curtailed investment in new exploration, depletion of reserves and OPEC+ discipline are harbingers of acute market tightness in the oil sector. Some experts predict that oil prices may reach a new three-figure peak at some point in 2022 (28). Currently Brent crude oil is hovering at around $80+/barrel, an unprecedented value in view of the market nadir of negative pricing observed in April 2020. With inflationary pressures becoming more pronounced as 2022 progresses, this can create significant economic disruption.

The European Commission published on 13 October 2021 a so-called ‘toolbox’ of short and medium-term measures to shield consumers from the impacts of spiralling energy prices (29). These include targeted tax and VAT rate reductions, state aid rule adjustments, as well as direct support to vulnerable consumers. The Commission has also pledged to address gas storage functioning and establish cross-border regional gas risk groups to analyse and advise Member States, and explore joint voluntary procurement of gas stocks. The EU Agency for the Cooperation of Energy Regulators (ACER) has been tasked to assess the design of the current wholesale electricity market by April 2022 (a preliminary assessment was released on 15 November 2021).

At the Extraordinary Energy Council meetings on 26 October and 2 December, EU ministers discussed the two documents. These meetings exposed a stark division between Member States upholding the current energy market design and those arguing for an overhaul of the marginal pricing system (30). Diverging views in relation to the inclusion of nuclear and gas in the EU green taxonomy, the viability of joint gas procurement as well as the extension of the ETS to the transport and construction sectors have also emerged (31). In the increasingly contentious debate, certain Member States have advocated positions at odds with the rules and objectives of the IEM dictums. France for instance has recently proposed an automatic electricity price stabiliser that ensures windfall profits accrued by producers are redistributed to the consumer (32). Spain has vigorously argued for decoupling electricity prices into marginal and inframarginal rates. Greece has called for the establishment of an EU fund for hedging against gas price spikes (33). There is a danger that the dissensions provoked by the energy crisis may spiral into lasting disagreement on the trajectory of the energy system and compromise or stall advances made in high-carbon divestment and structural resilience. This could potentially herald an era of heightened energy market volatility, escalating competition for scarce resources among Member States and in-between regions and polities, and ultimately an uncertain planetary future.

Conclusions

Disruption to energy markets might become a regular phenomenon in the years and decades ahead, fuelled by the impact of rising temperatures on ecosystems and climatic patterns, and by siloed policies and poorly managed decarbonisation processes. To boost resilience to price spikes, supply-demand imbalances, and other factors that in combination create perfect storms, policymakers need to deploy tried-and-tested methodologies but also imagine novel mechanisms to propel the transition forward. Targeted public investment needs to be directed to easing global supply bottlenecks, tackling systemic inefficiencies, and moderating demand, because this will not be the last crisis in the brave new world of clean energy. The electrification of the economy is necessary to drive the transition to clean energy sources, yet paradoxically this might make the system less resilient if the intermittency challenge is not resolved and polluting but reliable fossil fuel sources are jettisoned too quickly. This might lead to rolling blackouts, increasing societal stratification and inequalities, but also lost economic output. In the global competition for dwindling fossil fuel resources, smaller and poorer states would not be able to compete, amplifying global inequalities as well. As we advance into a critical decade for action on climate change, we need to embark on an honest holistic evaluation of energy systems’ resilience to conflict, extreme weather events, cyber/ hybrid attacks and infrastructure vulnerabilities and industrial accidents. Access to critical raw materials is also a central consideration looking ahead. The sustainability of ecosystems in the EU neighbourhood and in locations that are key for the commodities and minerals the EU needs to power the net-zero journey might also prove to be of existential importance. A precipitous or poorly managed shift away from hydrocarbon energy sources can also result in uncontrollable market turbulence and induce geopolitical strife and instability.

This will not be the last crisis in the brave new world of clean energy.

The ongoing energy crisis bolsters the case for the energy transition and the fight against dangerous global warming. It also exposes certain deficiencies in efforts to accelerate the transition process and broaden the notion of energy security and resilience, which may be either the result of negligence or of deliberate disregard. The vaulting ambition of climate neutrality has to be maintained, yet the less glamorous process of energy system hardening will shape the journey and decide the outcome. Europe can and should once again take the lead and show the way forward. This Brief has proposed some concrete measures to inform the process.

References

1. This Brief is based on previous analytical work conducted by the author in support of internal deliberations by the European Commission on the topic in early October.

2. IEA, Gas Market Report Q3-2021, including Gas 2021 -Analysis and forecast to 2024, 2021 (https://iea.blob.core.windows.net/assets/4fee1942-b380-43f8-bd86-671a742db18e/GasMarketReportQ32021_includingGas2021Analysisandforecastto2024.pdf).

3. Global LNG Hub, ‘China replaced Japan as world’s largest LNG importer in 1st half of 2021’, July 2021 (https://globallnghub.com/report-presentation/china-replaced-japan-as-worlds-largest-lng-importer- in-1st-half-of-2021).

4. Gas Market Report Q3-2021, op.cit.

5. Lazar, D., ‘Walking a tightrope: Natural gas prices hit new heights’, The Energy Industry Review, 24 August 2021 (https://energyindustryreview.com/oil-gas/walking-a-tightrope-natural-gas-prices-hit-new-heights/); Gas Infrastructure Europe, Aggregated Gas Storage Inventory (https://agsi.gie.eu/#/historical/eu).

6. Aggregated Gas Storage Inventory, op.cit.

7. Hernandez-Morales, A. and Hernandez, A., ‘Europe’s energy freakout’, Politico, 19 November 2021 (https://www.politico.eu/article/europe-energy-crisis-pipeline-natural-gas-eu/).

8. Marzec-Manser, T., ‘Gazprom’s inability to supply or unwillingness to deliver?’, Independent Commodity Intelligence Services (ICIS), 13 August 2021 (https://www.icis.com/explore/resources/news/2021/08/13/10674080/icis-analyst-view-gazprom-s-inability-to- supply-or-unwillingness-to-deliver/).

9. Ibid.

10. For an overview of the marginal pricing model, see European Commission, EU Energy Markets and Energy Prices Factsheet, 2020.

11. Eurostat, ‘Euro area annual inflation and its main components, December 2011 - December 2021’, 2021 (https://ec.europa.eu/eurostat/statistics-explained/index.php?title=File:Euro_area_annual_inflation_and_its_main_components,_December_2011_-_December_2021.png).

12. Yahoo Finance, Dutch TTF Natural Gas Calendar, 2021 (https://finance.yahoo.com/quote/TTF%3DF/history?p=TTF%3DF).

13. Ibid.

14. Lee, J., ‘Natural-gas market conditions look unnatural’, The Wall Street Journal, 11 September 2021 (https://www.wsj.com/articles/natural-gas-market-conditions-look-unnatural-11631368802).

15. Wilson, T. and Hume, N., ‘Ships carrying natural gas head for Europe as prices surge to new high’, The Financial Times, 21 December 2021 (https://www.ft.com/content/4885b7f5-97a2-4e66-af91-a9211956b0f5).

16. Eckert, V., Twidale, S. and F. Crellin, ‘Expensive winter ahead as Europe’s power prices surge’, Reuters, 10 September, 2021 (https://www.reuters.com/business/energy/expensive-winter-ahead-europes-power-prices-surge-2021-09-10/).

17. European Commission, Communication – ‘Tackling rising energy prices: a toolbox for action and support’, COM(2021) 660 final, 13 October 2021 (https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:52021DC0660&from=EN).

18. Aposporis, H., ‘Power prices reach stunning EUR 400 per MWh in Europe’, Balkan Green Energy News, 20 December 2021 (https://balkangreenenergynews.com/power-prices-reach-stunning-eur-400-per-mwh-in-europe/)

19. Bloomberg, ‘Aluminum’s surge is an energy crisis in disguise linked to heavy coal reliance’, 27 September 2021 (https://www.bloomberg.com/opinion/articles/2021-09-27/aluminum-s-surge-is-an-energy-crisis-in-disguise-linked-to-heavy-coal-reliance).

20. Komileva, L., ‘Stagflation risk returns for investors as gas prices surge’, The Financial Times, 6 October 2021 (https://www.ft.com/content/1e68148c-7f61-4bb4-af68-aa2c7d898111).

21. For an outline of Member State policies, see Sgaravatti, G., Tagliapietra,S. and Zachmann, G., ‘National policies to shield consumers from rising energy prices’, Bruegel Datasets, 4 November 2021 (https://www.bruegel.org/publications/datasets/national-policies-to-shield-consumers-from-rising-energy-prices/).

22. Allegations by the US that Russia exerted market manipulation obscure the fact that US LNG cargoes were not dispatched to bring relief to the EU.

23. Paradoxically, the IEA which in its flagship report in May 2021 urged the world to curb fossil fuel investments, reversed course and called on Russia to increase gas supplies to the EU in September. See: Ziady, H., ‘Russia urged to pump more gas to Europe as energy prices soar’, CNN, 22 September 2021 (https://edition.cnn.com/2021/09/22/business/iea-russia-gas-europe/index.html)

24. IEA, Net Zero by 2050: A Roadmap for the Global Energy Sector, 4th revision, October 2021 (https://www.iea.org/reports/net-zero-by-2050)

25. California could not ensure system reliability with its ambitious solar and wind deployment, and requested the US federal government to allow it to extend the life of fossil fuel plants earmarked for closure, build natural gas plants, and increase pollution limits. See Department of Energy, Order No 202-21-2, 10 September 2021 (https://www.energy.gov/sites/default/files/2021-09/EXEC-2021-005025%20-%20Order%20202-21-2%20-%20signed%209-10-21.pdf).

26. There is no common definition of ‘energy poverty’ across the EU, which might result in a statistical misrepresentation. An assessment by the Joint Research Centre in 2019 classified 50 million people as energy poor. Some other estimates point to as many as 80 million people.See Gangale, F. and Mengolini, A., Energy poverty through the lens of EU Research and Innovation projects, Publications Office of the European Union, Luxembourg, 2019; European Cooperation in Science and Technology, ‘80 million European households struggle to stay warm. Rising energy costs will make the problem worse’, 12 November 2021 (https://www.cost.eu/80-million-european-households-struggle-to-stay-warm-rising-energy-costs-will-make-the-problem-worse/).

27. The term denotes the decrease in global average surface wind speed which has been observed over the last four decades.

28. Hume, N., ‘Trafigura chief warns of rolling power outages in Europe this winter’, The Financial Times, 16 November 2021 (https://www.ft.com/content/a06df5b2-58ff-46f2-920d-a5ebaca68b11).

29. ‘Tackling rising energy prices: a toolbox for action and support’, op.cit.

30. France and Spain argue that the turbulence in the energy market reveals the deficiencies of the current market structure in open contrast to a group led by Germany and the Netherlands that defends the existing model, a view also supported by the Energy Commissioner.See ‘Energy Prices in the EU, Joint Statement from AT DE DK EE FI IE LU LV NL’, 25 October 2021 (https://www.politico.eu/wp-content/uploads/2021/10/25/2021-10-25-Energy-Prices-in-the-EU-Joint-Statement-AT-DE-DK-EE-FI-IE-LU-LV-NL.pdf).

31. Transport, Telecommunications and Energy Council, Public session, 26 October 2021 (https://video.consilium.europa.eu/event/en/25028).

32. France24, ‘Energie: il faut «tempérer la logique de marché» en Europe, estime Bruno Le Maire’, 8 November 2021 (https://www.france24.com/fr/info-en-continu/20211108-energie-il-faut-temp%C3%A9rer-la-logique-de-march%C3%A9-en-europe-estime-bruno-le-maire).

33. For a summary of the positions of different Member States, see Sgaravatti, G., Tagliapietra, S. and Zachman, G., ‘Rising energy prices: European Union countries’ views on medium-term policies’, Bruegel, 29 November 2021 (https://www.bruegel.org/2021/11/rising-energy-prices-european-union-countries-views-on-medium-term-policies/).