You are here

Arctic stress test

Introduction

The Arctic is again becoming a region of strategic focus. For three decades after the Cold War, when the region was at the centre of great power competition, successful cooperation transformed the Arctic into a ‘low tension’ zone and consolidated the perception of ‘Arctic exceptionalism’, the sense that the region is uniquely cooperative and immune from broader geopolitical tensions. For the eight Arctic states that comprise the Arctic Council – Canada, Denmark, Finland, Iceland, Norway, Sweden, Russia and the US – there has been hope that regional dynamics can be insulated from global geopolitical shifts.

However, two phenomena are challenging the notion of Arctic exceptionalism and testing the limits of regional governance. First, climate change is accelerating the melting of polar ice at a historically unprecedented pace. Ever larger swathes of the Arctic are becoming accessible, and with them the region’s untapped natural resources, raising the prospect of increased human activity. Second, great power competition between the US, Russia and China in and for the Arctic is intensifying, changing regional power dynamics and exposing the region to ‘spillover’ effects from competition in Europe and the Indo-Pacific. These changes are accentuated by the erosion of the rules-based international order which underpins Arctic governance, the dismantling of the arms control regime, and the rapid proliferation of advanced military capabilities. Physical presence and ownership of infrastructure are becoming vectors of influence, as evidenced by President Trump’s offer to ‘buy Greenland.’ Meanwhile, Russian bombers regularly approach European and North American airspace and Russian submarines are increasingly present in the Norwegian and North Seas, constantly probing the agility of Euro-Atlantic defences. The growing Chinese presence in the region creates economic and financial dependencies. Consequently, what happens in the Arctic affects more than just regional actors.

What does great power competition for access to and control of the Arctic mean for Euro-Atlantic security? In answering this question, this Brief argues that the Arctic will be a strategic stress test for European defence and for the transatlantic bond. The paper is structured in three parts. The first part outlines the security challenges and the drivers of geopolitical change in the Arctic. The second part examines the features of great power competition in this region and the implications for European and transatlantic defence. The final section of the Brief offers policy considerations for European and transatlantic decision-makers on how to mitigate the negative consequences of these regional dynamics.

Arctic challenges

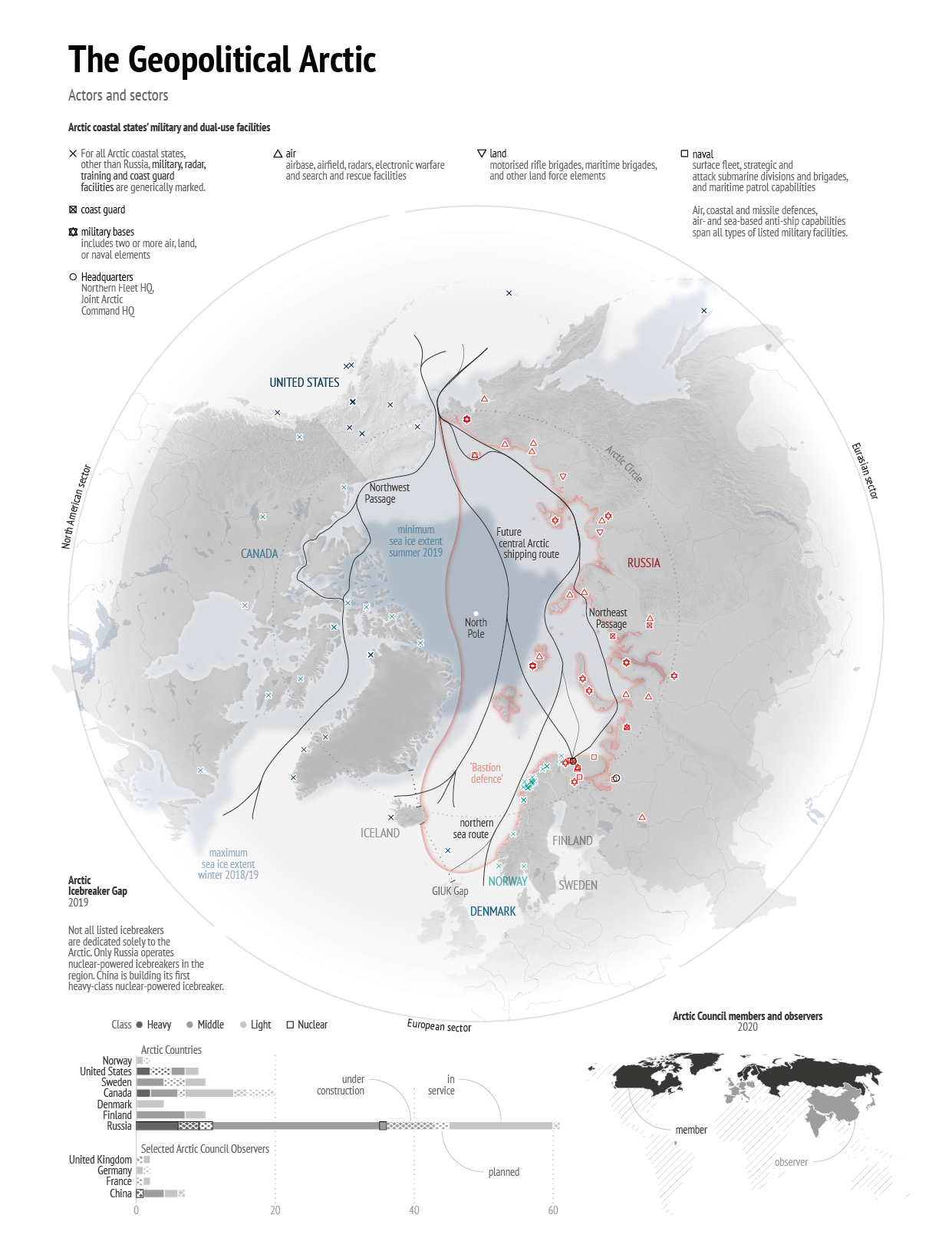

The Arctic is feeling the full brunt of climate change. Polar temperatures are rising faster than the global median.1 Roughly 75% of Arctic ice has melted in the last century. The effects of climate change are unequally distributed across the High North, with ice melting at a faster rate in the European and Eurasian sectors, due to the warmer Gulf Stream current. Climate change in the Arctic is increasingly contributing to climate change elsewhere on the globe2 and is rapidly becoming a catalyst for broader changes in regional security, including environmental protection, biodiversity, food and economic security.3 While the Arctic represents only 2.8% of the earth’s total surface area and is home to 0.5% of the world’s population (approximately 4 million people), new maritime routes are opening between the North Atlantic and the North Pacific and the region contains significant energy and mineral resources.

Regional security dynamics have strategic implications well beyond Arctic geographical boundaries and particularly for Euro-Atlantic defence.

Arctic governance is dense, and cooperation has become the prevalent practice over the past three decades, even amid tensions over the illegal Russian annexation of Crimea. The main governance instrument is the Arctic Council (1996). Regional states have traditionally emphasised their Arctic sovereignty and have been sceptical about allowing non-Arctic countries to influence regional governance. This is reflected in long-standing practices in the Arctic Council, where a number of European and Asian countries are observers4 but are not involved in the decision-making process. This is unlikely to change anytime soon,5 particularly as the Arctic states attempt to limit the ‘strategic spillover’ of great power rivalry from other regions of the globe.6

Some argue that the return of great power competition signals the end of Arctic cooperation,7 while Arctic Council officials urge international actors to avoid fixing an instrument that is not broken. First, non-Arctic countries like China are increasingly testing the limits of regional governance. Unlike the EU, whose observer status was blocked by Moscow, China was accepted as an observer within the Arctic Council, and since then it has actively promoted broader, formal involvement of non-regional states in Arctic governance. In its 2018 Arctic Strategy, Beijing describes itself as a ‘near-Arctic country.’8 The US has officially rejected this Chinese self-designated status, but smaller actors like Iceland and Greenland are still carefully considering the balance between risk and opportunity in engaging Beijing. Second, Russian military activities above the Arctic Circle expose a significant limitation of regional governance – namely, it does not cover military security. Nevertheless, regional security dynamics have strategic implications well beyond Arctic geographical boundaries and particularly for Euro-Atlantic defence. As demonstrated by the French (2016), British (2018) and German (2019) Arctic strategies, it is equally important to be vigilant about geopolitical spillover from the Arctic to neighbouring regions.

Arctic great power competition

The US, Russia and China actively compete in the Arctic to exploit energy and mineral resources and develop infrastructure. They also compete for the Arctic, specifically for maritime and economic access in the region and for military dominance. Secretary Pompeo’s 2018 speech before the Arctic Council signalled the return of great power competition to the Arctic: ‘We’re entering a new age of strategic engagement in the Arctic, complete with new threats to the Arctic and its real estate, and to all of our interests in that region.’9 This increased competition is evident across a number of issue areas.

In icy waters

Climate change is a catalyst for strategic rivalry in the High North because of the progressive opening of new maritime routes. By 2030 the region may have entirely ice-free late summers especially in the European and Eurasian sectors. In the mid- to long-term, this opens up three Arctic routes: the Northeast Passage (NEP) alongside the Eurasian coast towards the North Pacific, the Northwest Passage (NWP) alongside the North American coast towards the North Pacific and the Transpolar Passage (TPP), across the Central Arctic Ocean. Since 2014, 20-30 ships transit the NEP every year and cargo volume has risen steadily – although it is still significantly behind alternative routes through the Suez Canal and the Malacca Strait. Although the NEP is potentially a faster route between Europe and Asia, harsh conditions, ice floe, partially uncharted waters, insufficient support and refuelling infrastructure, and the high cost of ice-reinforced ships and crew training make the route less economically appealing. Fixing all these issues will take time – just charting Arctic waters may take decades – and will place a premium on law enforcement, to ensure compliance with navigation, environmental and border management regulations, and on improved emergency response, especially search-and-rescue capacity.10

One area of contention is the freedom of navigation along these new Arctic routes. Russia’s 2020 Arctic Strategy reaffirms that the region is critical to economic development, particularly in the Far North and East, and Moscow’s great power status.11 Since 2016, Moscow has claimed the NEP as its sole sovereign jurisdiction, has introduced requirements for all foreign ships transiting the NEP (e.g. 45-days’ advance notice and presence of Russian ice-pilots onboard), and has warned that foreign ships transiting the NEP would be detained or sunk if they did not comply with Russian regulations. Washington has rejected Moscow’s claims. The Department of Defense 2019 Arctic Strategy states the US Navy will sail anywhere in the High North where international law allows, although the deployment of a US carrier group in the 2018 Trident Juncture exercise was the first large-scale American naval deployment north of the Arctic Circle in thirty years. China has also claimed free navigation rights in the Arctic and has included the NEP in its Belt-and-Road Initiative (BRI), as the so-called Polar Silk Road. France, Germany and the UK also emphasise freedom of navigation as a fundamental principle in the Arctic.

One area of contention is the freedom of navigation along these new Arctic routes.

Situational awareness and physical access to the Arctic are still dependent on icebreakers and these capabilities are in short supply among European and North American Arctic states. Russia operates over 40 icebreakers – 57% of the icebreaking capabilities of Arctic states – and is the only nation with heavy nuclear-powered icebreakers (capable of operating year-round and breaking ice over 1.5m deep). In 2013, Washington announced plans to build six new icebreakers for the coast guard, including heavy-class vessels, although uncertainty remains over final numbers and delivery dates.12 The US Navy, the largest in the world, only operates two heavy-class icebreakers, of which only one is operational. China also has two heavy-class icebreakers, both operational, and is reportedly building its first nuclear-powered icebreaker. European Arctic states possess significant civilian icebreaking capabilities, but these generally operate in the summer season (July-October) in ice thinner than 1m. None of the European Arctic states operate heavy-class icebreakers.

Cargo between Europe and the Indo-Pacific represents 60% of all NEP transit.13 Copernicus data shows that most of these transits will require icebreaking capabilities well into the 2040s. Therefore, the Arctic icebreaking capability gap is consequential, particularly for commercial transport. Military power projection does not entirely depend on such capabilities and European Arctic states, the US, the UK and France operate ice-hardened naval capabilities (e.g. frigates, offshore patrol vessels, etc). Icebreakers can be effective signalling tools for long-term presence, law-enforcement and even defence (if armed, as is the case of Russia). Commercial and research fleets aside, most Arctic countries have developed icebreaking capabilities in their coast guard forces (e.g. patrolling territorial waters or search-and-rescue missions) or research institutions. Russia and Norway are exceptions because their territorial defence depends in some measure on these capabilities. Meanwhile, China, France and the UK are developing icebreaking capabilities within their navies, to enable power projection in the Arctic over long distances.

Arctic energy

The 2008 US Geological Survey estimated that the Arctic has roughly 13% of oil and 30% of natural gas reserves yet to be discovered globally. 75% of Russian oil, 95% of its gas reserves and 65% of Norway’s oil reserves are in the Arctic,14 although exploration has yielded mixed results. While Russia’s Yamal gas projects are rapidly developing, since 2013 several energy giants like Cairn Energy and Shell Oil have indefinitely suspended operations in the European and North American Arctic because of poor results. Different regulatory approaches among Arctic states have diminished interest in exploiting energy resources, too. Norway has limited drilling in the Norwegian Sea while the US and Russia have expanded drilling in the Alaskan Arctic and the Yamal peninsula, respectively. Harsh weather conditions, environmental concerns, high risks of accidents (e.g. oil spills), insufficient support infrastructure, prohibitive insurance costs and low energy prices have also contributed to dampening investor interest.

France, the UK and China have a direct stake in Arctic energy projects, which are increasingly important to the security of their energy supply. To diversify Russian energy markets, the Yamal peninsula gas projects will supply both the Asian and the European markets.15 This may become a complicating factor in the transatlantic relationship. The US has long opposed energy projects that increase European dependency on Russian fossil fuels, while seeking to increase American Liquefied Natural Gas (LNG) exports to Europe. Congress threatened to impose sanctions against North Stream participants while appropriating $1 billion in funding for various energy projects within the Three Seas Initiative, including projects for the construction of LNG terminals and interconnectors across Eastern Europe.

Arctic strategic minerals

Greenland holds a quarter of the world’s rare earths, making it a viable ‘alternative to China’s monopoly on these strategic metals.’16 China is already the world’s largest rare earths exporter and has shown great interest in mining in Greenland and Iceland. Beijing weaponised restrictions of rare earths exports during a 2013 Sino-Japanese boundary dispute17 and could employ dumping strategies to reduce European and American investor interest in exploiting Arctic rare earths. During the Sino-American trade war, Beijing threatened to reduce strategic minerals exports to the US and any other state that engages in ‘suppression’ against China.

A 2018 review of the US National Defence Industrial Base revealed 50% of defence contractors depend on rare earths imports from China which are used in radar and sonar systems, missile guidance, jet engines, and armoured vehicles.18 The EU’s dependency on Chinese rare earths has also increased in the last decade. A 2017 European Commission study revealed critical chokepoints in the supply chain of rare earths, with China providing 95% of Europe’s imports of these elements.19 A 2016 study found the EU relies 100% on China as a single supplier for a majority of critical rare earths and semi-finished materials for specific European defence applications, with ‘the defence industry’s aeronautics and electronics sectors the most vulnerable to potential interruptions in the supply chain of materials.’20 This is a critical vulnerability for the development of the European digital economy and the digitalisation of European armed forces.

Arctic states have been concerned about rapidly growing Chinese investment in the Arctic, seen as an ‘anchor’ for Beijing’s growing regional physical presence and influence. American and European pressure on Iceland and Denmark/Greenland to limit Chinese access to mining and infrastructure projects has increased over the last four years. The EU has developed tools to assist member states in assessing security risks posed by foreign direct investment (FDI), including from China. Nevertheless, excluding Chinese participation does not automatically ensure control over these strategic resources. Though obstacles persist,21 effective European exploitation of rare earths in Greenland would reduce a significant strategic EU vulnerability and would contribute to its technological sovereignty and the implementation of the Commission’s 2020 Industrial Strategy. Failure to do so may threaten the Union’s ability to develop its defence industry and its digital economy and to remain competitive with the US and China.

Connecting the Arctic

With increased human activity in the Arctic come enhanced opportunities for economic development. Modern economies, fuelled by rapid technological progress, require ever greater transport and communications connectivity, but these are not without significant challenges.22 In 2015, Finland launched Arctic Connect, a project to build an underwater communication cable to connect Europe and Asia via the Arctic. The cable – an alternative to existing but vulnerable underwater cables crossing the Red Sea – would provide faster and more reliable internet, data and communication connectivity between the two continents.

Effective European exploitation of rare earths in Greenland would reduce a significant strategic EU vulnerability.

The project was awarded to Huawei Marine, a branch of the Chinese high-tech giant Huawei, a decision supported by Beijing as part of its Digital Silk Road initiative. However, this sparked Western concerns. While Finland is interested in leveraging the project to develop data centres – a priority under the Commission’s 2020 EU Data Strategy – ensuring the integrity and security of this data is very challenging. Concerns that the cable might be covertly used for Chinese intelligence gathering and underwater surveillance led to Western – particularly American – pressure to reallocate the contract. Although Huawei Marine stepped back, its successor in the project is still a Chinese company.23

The White House and Congress will maintain pressure on NATO allies and partners to reconsider Chinese involvement in critical digital infrastructure, with the US threat to stop sharing information with them still looming in the background. The EU has new mechanisms in place to assist member states in screening and assessing the security risks from Chinese FDI projects in the field of digital and telecommunications critical infrastructure, but decisions remain a matter of sovereign authority and ensuring European consistency on licensing telecommunication and digital infrastructure projects is critical but challenging.

Data: Arctic Council, 2020; Chatham House, 2019; CRS, 2020; CSIS, 2020; IISS, 2020; Jane's Defence, 2019; Natural Earth, 2020; NSIDC, 2020; RUSI, 2018; Simons Foundation, 2019; SIPRI, 2018; USCG, 2020

Arctic military competition

While all Arctic countries are modernising their military infrastructure and capabilities, it is Russia’s military efforts that are most concerning. Since 2008, Russia has reopened and modernised over four dozen military bases and dual-use sites in the High North. Moscow has established a joint military command and two new heavy brigades for the Arctic. It has modernised surface and submarine components of its Northern Fleet, deployed advanced missile and air-defence systems along its Arctic coast, and deployed advanced dual-use cruise and ballistic missiles in the region.24 Since 2008, Russia holds regular military exercises in the Arctic, including simulating offensive manoeuvres against Norway or in the Greenland-Iceland-UK (GIUK) Gap, jamming allied military equipment during the 2018 Trident Juncture exercise, and testing cruise missiles.

Some argue Russian capabilities are mainly defensive, related to the ‘Bastion concept’ designed to protect its strategic second-strike capability in the Kola Peninsula.25 Russia is certainly rebuilding its Arctic military footprint and infrastructure from a historical post-Cold War low. However, as demonstrated by numerous Russian exercises, Bastion defence is increasingly reliant on multilayered anti-access, area denial (A2/AD) capabilities and offensive power projection from the Arctic into the neighbouring North Atlantic and elsewhere – including by using Russia’s strategic nuclear submarines, attack submarines, and sea and air-launched cruise and ballistic missiles.26 The density and variety of advanced weaponry in the Western half of Russia’s coastline is indicative of the intensifying strategic competition in the European sector of the Arctic.

Some are also alarmed by signs of strengthening Sino-Russian cooperation in the Arctic.

While the chances of regional military conflict remain low,27 Russian capabilities pose a significant challenge to NATO’s ability to protect the transatlantic sea lines of communications (SLOC) in the high North Atlantic and GIUK Gap, a strategic chokepoint for Euro-Atlantic defence and North American naval reinforcement of Europe during a crisis.28 Indeed, ‘the unavoidable operational reality is that should conflict arise, whoever can exert control over this region can either protect or threaten all of NATO’s northern flank.’29 Moscow’s advanced A2/AD capabilities in the High North (and in Kaliningrad) are a formidable challenge and hold at risk allied military bases above and below the Arctic Circle, from Norway to Italy and from the Baltics to the continental US. Clearly, Arctic military competition directly affects Euro-Atlantic defence.

Alongside its growing economic, research and maritime presence, Chinese participation in Russian Arctic military exercises has sparked concern. Washington claims ‘civilian research could support a strengthened Chinese military presence in the Arctic Ocean, which could include deploying submarines to the region as a deterrent against nuclear attacks.’30 Some are also alarmed by signs of strengthening Sino-Russian cooperation in the Arctic. While still preponderantly energy and commercially driven, the expected intensification of relations between Beijing and Moscow during the latter’s upcoming presidency of the Arctic Council (2021-2023) may still extend to military cooperation – a scenario most detrimental to European and transatlantic interests.

These trends challenge Arctic states’ ability to counter Russian and Chinese presence. While Canada, Norway and Denmark have announced increases in Arctic defence spending (uncertain in light of the economic consequences of the Covid-19 crisis), the US administration’s strategic commitment to the region is competing against other areas of more urgent concern. The US is the only Arctic nation not to have a strategic Arctic port, and is evaluating the possibility of designating or building one, possibly in the Nome/Port Clarence region. While this location has been considered previously, the Alaskan Arctic’s relatively shallow shores and the challenges to developing resilient military infrastructure in permafrost conditions have meant that so far American plans have been put on hold. Unreliable signal and communications infrastructure remain a significant limitation for military presence above the Arctic Circle.31

Enduring capability gaps are affecting the transatlantic allies’ situational awareness and power projection in the Arctic, too. Canada and European allies lack sufficient maritime patrol, command, control, computers, communications, intelligence, surveillance and reconnaissance (C4ISR), anti-submarine warfare and electronic warfare capabilities. Meanwhile, the Northern Warning System (NWS) – a 1990 North American network of sensors and radars, extending all the way into Greenland, and designed to provide early warning against incoming Russian nuclear attack – is increasingly unreliable in detecting sea or air-launched Russian cruise missiles and strategic bombers.32 Ottawa and Washington are considering options for modernising the NWS, but the enhanced capability will not be available before 2035. In light of Russia’s growing arsenal of cruise and intermediate-range ballistic missiles, capable of reaching any corner of Europe and most of North America, and its hypersonics capability development, European countries will need to consider bolstering their missile and air defences.

Breaking the ice? Implications for European and transatlantic defence

Great power competition in the Arctic is intensifying in its European sector. The US, Canada, European Arctic countries and the EU need to redouble efforts at multilateral cooperation as a matter of priority, particularly through the Arctic Council. Nevertheless, strategic rivalry will inevitably subject European defence and the transatlantic bond to an Arctic stress test.

First, transatlantic allies and partners need to overcome the deadlock on what, if any, NATO’s role is in the Arctic. Finding the right role for NATO will not be easy,33 and NATO Arctic allies and partners need a strong voice in this process. This is not about NATO permanent military presence or strategic parity in the region, which NATO has avoided in order not to provoke Russia.34 Rather, measures could be stepped up on the Alliance’s ability to reinforce and defend all allies (art V), including Arctic ones, and acknowledging the relationship between the Arctic and broader Euro-Atlantic defence against Arctic-based Russian capabilities. The Secretary General’s group of experts, appointed in March 2020, which includes three representatives from Arctic countries, presents an excellent opportunity to engage in this debate.

NATO’s recent adaptation is already addressing some of these challenges. The establishment of the command in Norfolk, Virginia and the re-establishment of the 2nd US Fleet, both responsible for defending the transatlantic SLOC, consolidate allied maritime and air superiority in the North Atlantic against Russian capabilities in the Arctic without requiring extended allied presence in the region. An increased tempo of Arctic military exercises and small rotational presence also helps to reassure Arctic allies and partners and maintain interoperability, including with enhanced partners Finland and Sweden. Furthermore, Secretary General Stoltenberg recently argued, ‘we also need to make sure that NATO is present in the Arctic. And some of the investments we make in new ships, maritime capabilities, surveillance capabilities, but also aircraft capabilities are relevant for the Arctic.’35 This is all the more true in light of expected defence budget cuts as a result of a Covid-19-induced economic downturn.

The allies could consider developing a collective approach towards enhanced situational awareness in the High North, by pooling and sharing scarce capabilities and sharing data. This could create a common operating picture of Russian and Chinese challenges and provide strategic-political guidance to mitigate the risk of possible sea and air incidents and miscalculations in the Arctic. The collective approach would build on US interest in stronger cooperation with allies on layered enhanced domain awareness, real-time data fusion, multi-domain command and control, and capabilities suitable for defending the Arctic,36 and on Canadian, British and French visions of the region as a ‘laboratory for new technologies in information and communication, robotics, automation, airborne systems and sensors.’37 Leveraging allied and bilateral military and diplomatic networks, a common NATO approach would incentivise American leadership and help Canada and European allies enhance their contributions to burden-sharing in niche areas while preserving regional states’ pragmatic cooperation with Russia in the Arctic. European allies could consider a number of complementary measures, including the recent proposal by the Center for Strategic and International Studies (CSIS) for an American Arctic Security Initiative (ASI) modelled after the European Deterrence Initiative (EDI).

Russia’s upcoming presidency of the Arctic Council is an opportunity for transatlantic allies to call on Moscow to adopt a more responsible regional posture.

Second, while the region is not a primary theatre of operations, Russia’s perception that it can use the Arctic for effective signalling to rival powers, through weapons testing or limited escalation, should be dispelled.38 Russia is already using the Arctic to signal its defensive and power projection capabilities and test advanced standoff weapons, including missiles and hypersonics. The transatlantic allies and partners could consider targeted, confidence-building measures with Russia in the Arctic to provide them with a better understanding of regional ‘tipping points’39 (i.e. issues likely to spark escalation) to prevent miscalculations. Russia’s upcoming presidency of the Arctic Council is an opportunity for transatlantic allies to call on Moscow to adopt a more responsible regional posture, especially given the rapid erosion of the arms control regime, including the demise of the Intermediate-Range Nuclear Forces Treaty (INF) and the recent discussions in Washington about withdrawing from the Open Skies Treaty.

Third, European and transatlantic decision-makers need to start investing in Arctic economic development and infrastructure now and progressively enhance such investments over the mid-term. Short of a broad and direct role, the EU still has an important role to play in the Arctic. As European leaders have highlighted, ‘developments in the Arctic are progressing at rapid pace. The European Union needs to ensure that its own policy approach would take account of relevant developments.’40 Updating the 2016 policy is a good opportunity for the EU to develop a more comprehensive strategy for the Arctic if Brussels is to be a more influential regional player. Brussels’ funding and regulatory power allow it to play an important role in supporting Arctic EU states in climate change, research, economic and infrastructure development as well as in harmonising the application of FDI risk assessment to Chinese projects among Arctic member states. Horizontal linkage between the EU’s Green Deal and its updated Arctic strategy could be strengthened. Cooperation on Arctic security could be considered as part of the future EU-UK security relationship. Copernicus is already contributing significantly to Arctic situational awareness and research, but other EU instruments like Permanent Structured Cooperation (PESCO), the European Defence Fund (EDF) and EU-NATO cooperation are not yet fully leveraged by Arctic member states to jointly develop needed capabilities and build better regional situational awareness.

References

1) Intergovernmental Panel on Climate Change, Special Report: Global warming of 1.5°C, 2018.

2) European Commission, Joint Communication on An integrated European Union policy for the Arctic, JOIN(2016) 21 final, Brussels, April 27, 2016 , p. 2.

3) Ekaterina Klimenko, “The Geopolitics of the Changing Arctic”, SIPRI Background Paper, December 2019, pp. 3-8.

4) Arctic Council observers are France, Germany, Italy, the Netherlands, Poland, Spain, Switzerland, the United Kingdom, Japan, South Korea, China, India and Singapore. For a complete list, including intergovernmental and non-governmental observers see https://arctic-council.org/en/about/observers/.

5) Author’s interview with Arctic Council official, 24 July 2019.

6) US Department of Defense, Report to Congress: Department of Defense Arctic Strategy, June 2019.

7) Michael Paul, “Polar Power USA: Full Steam Ahead into the Arctic”, SWP Comment no. 42, November 2019.

8) Chinese State Council, China’s Arctic Policy – White Paper, January 2018.

9) US State Secretary, Michael R. Pompeo, “Looking North: Sharpening America’s Arctic Focus”, Rovaniemi, Finland, May 6, 2019.

10) Ernie Regehr, “Replacing the North Warning System: Strategic competition or Arctic confidence building?”, The Simons Foundation, March 1, 2018.

11) Marlene Laruelle, “Russia’s Arctic Policy: A Power Strategy and Its Limits”, Notes de l’IFRI, March 2020.

12) Governmental Accountability Office, “Arctic Capabilities: Coast Guard Is Taking Steps to Address Key Challenges, but Additional Work Remains”, GAO-20-374T, February 5, 2020.

13)Northern Sea Route Information Office, Transit Statistics 2018.

14) Heather A. Conley and Matthew Melino, America’s Arctic Moment: Great Power Competition in the Arctic to 2050, CSIS, March 2020.

15) Author’s interview with academic from University of Ottawa, February 27, 2020.

16) Ministry of Foreign Affairs of France, The Great Challenge of the Arctic: National Roadmap for the Arctic, June 2016, p. 25.

17) Valerie Bailey Grasso, “Rare Earth Elements in National Defense: Background, Oversight Issues, and Options for Congress”, Congressional Research Service Report R41744, December 23, 2013.

18) White House, Assessing and Strengthening the Manufacturing and Defense Industrial Base and Supply Chain Resiliency of the United States: Report to President Donald J. Trump by the Interagency Task Force in Fulfillment of Executive Order 13806, September 2018, pp. 28-29, p. 94.

19) European Commission, Study on the review of the list of Critical Raw Materials: Critical Raw Materials Factsheets, June 2017, p. 6.

20) Claudiu C. Pavel and Evangelos Tzimas, “Raw materials in the European defence industry”, JRC Science for Policy Report, European Commission, 2016, p. 4.

21) Institute for Applied Ecology, Study on EU Needs with Regard to Co-operation with Greenland: Final Report, June 2015, p. 34.

22) Marc Lanteigne, “The Internet in the Arctic: Crucial Connections”, Over the Circle, March 5, 2020.

23) Frank Jüris, “Handing over infrastructure for China’s strategic objectives: ‘Arctic Connect’ and the Digital Silk Road in the Arctic”, Estonian Foreign Policy Institute, Synopsis, March 7, 2020.

24) Siemon T. Wezeman, “Military Capabilities in the Arctic: A New Cold War in the High North?”, SIPRI Background Paper, October 2016.

25) Stephanie Pezard, “The New Geopolitics of the Arctic: Russia’s and China’s Evolving Role in the Region”, RAND, November 26, 2018.

26) Mathieu Boulègue, “Russia’s Military Posture in the Arctic Managing Hard Power in a ‘Low Tension’ Environment”, Chatham House Research Paper, June 2019.

27) European Command, EUCOM Posture Statement 2018, March 8, 2018.

28) Harri Mikkola, "The Geostrategic Arctic: Hard Security in the High North", FIIA Briefing Paper, April 2019, p. 5.

29) James G Foggo and Alarik Fritz, “NATO and the Challenge in the North Atlantic and the Arctic”, Whitehall Papers, vol. 93, no. 1, May 2018, p. 121.

30) US Department of Defense, Annual Report to Congress: Military and Security Developments Involving the People’s Republic of China 2019, May 2019, p. 114.

31) Roland O’Rourke et.al., “Changes in the Arctic: Background and Issues for Congress”, Congressional Research Service Report R41153, January 23, 2020.

32) Andrea Charron et.al, NORAD: Beyond Modernization, University of Manitoba, January 31, 2019, p. 13.

33) Tomáš Valášek (ed.), New Perspectives on Shared Security: NATO’s Next 70 Years, Carnegie Europe, December 2019, pp. 48-49.

34) NATO, Joint press conference with NATO Secretary General Jens Stoltenberg and the Minister of Defence of Norway, Frank Bakke-Jensen, at the Trident Juncture 2018 distinguished visitors’ day, October 30, 2018.

35) Jens Stoltenberg, Questions ans Answers at the “NATO Engages: Innovating the Alliance” conference, NATO, London, December 5, 2019.

36) US Department of Defense, Report to Congress: Department of Defense Arctic Strategy, June 2019.

37) The Great Challenge of the Arctic: National Roadmap for the Arctic, op. cit., p. 27.

38) Author’s interview with academic from Manitoba University, July 3, 2019.

39) Wilson Center, A Governance and Risk Inventory for a Changing Arctic: Background Paper for the Arctic Security Roundtable at the Munich Security Conference 2020, 2020.

40) European Council, “Council Conclusions on the EU Arctic policy”, 14952/19, Brussels, December 9, 2019.