The EU’s commitment to the energy transition is undeniable, with policies like the European Green Deal and the Net-Zero Industry Act paving the way towards a climate-neutral Europe. As European Commission President Ursula von der Leyen clearly stated at the World Economic Forum in 2023, the plan is ‘to make Europe the home of clean tech and industrial innovation on the road to net zero’ (1).

Ambitious rhetoric notwithstanding, the overall mood across EU capitals is rather muted. Expressions of concern about the erosion of the EU’s clean tech industry and the need to ‘catch up’ and ‘not fall behind Beijing’ have dominated the political narrative (2). Meanwhile, policymakers have regularly floated subsidies and tariffs as solutions to the EU’s industrial woes (3). While these policies can level the playing field, they alone will not help the EU reach its goals. To be at the forefront of industrial innovation, the EU must focus on the technologies of tomorrow.

Back to the drawing board

The EU’s capacity to reach its energy goals without exacerbating its dependence on countries like China hinges upon its capacity to embrace innovation. While the list of promising technologies that should merit greater attention is endless, limited resources call for prioritisation.

Given the need for rapid decarbonisation, it is crucial to focus on technologies with near-to-mid-term deployment potential. While unexpected breakthroughs in areas like nuclear fusion might happen in the distant future, it would be unwise to rely on them too much. Meanwhile, infinitely more mature technologies like small modular nuclear reactors (SMRs) offer a much better chance of reducing the EU’s greenhouse gas (GHG) emissions, but this will still not happen anytime soon. It is unlikely that the first commercially available SMRs will hit the market before the early 2030s, making it difficult to assess to what extent this technology will be a competitive source of power.

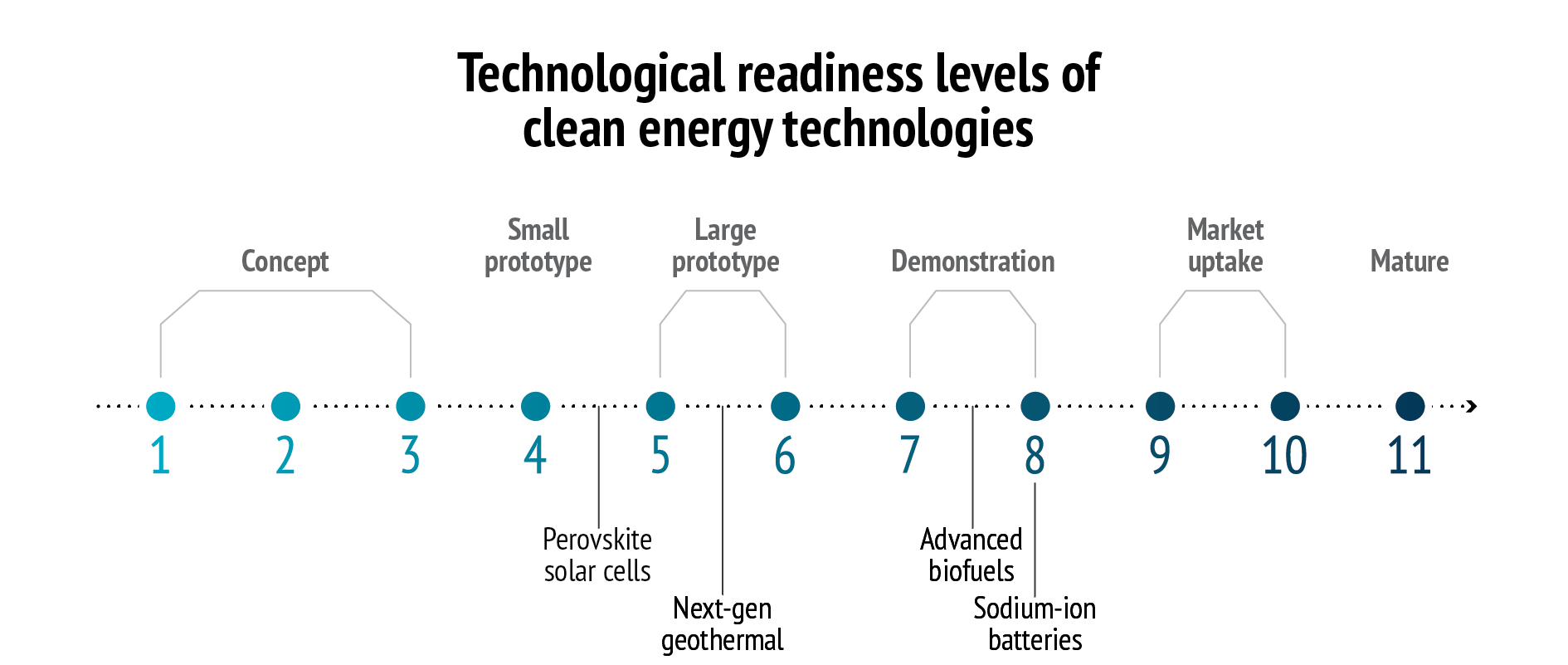

The following sections will explore four emerging technologies that the EU could harness to advance its energy and climate goals. While these are at varying levels of technological readiness, they align well with current energy policies and have the potential to complement ongoing infrastructure development efforts.

Perovskite solar cells

The EU’s renewable energy mix is heavily reliant on traditional solar cells made from silicon. However, recently a new contender has emerged: perovskite solar cells. They boast several advantages over their silicon counterparts (4).

Their unique material properties offer higher solar energy conversion capacities. Most traditional solar panels have efficiencies of about 22%, while perovskites reach around 25% and have even higher potential (5). Perovskites also offer a more sustainable alternative. Unlike silicon cells, which require high temperatures for the production of wafers, manufacturers can produce perovskite crystals at relatively low temperatures, reducing lifecycle GHG emissions (6). Additionally, labs can grow perovskites using lead and other commonly available materials, eliminating the need for environmentally disruptive practices like mining and refining of quartz, the source material for silicon (7).

Perovskites might also help reduce the EU’s dependence on Beijing. In 2023, over 90 % of the EU’s solar panels originated in China (8). This trend is unlikely to change as government incentives and other factors keep manufacturing costs for solar panels roughly 50 % lower in China (9). Therefore, even if the EU cannot compete solely on cost with Chinese-made silicon cells, a superior product like perovskite solar cells, even at a potentially higher price point, could still contribute significantly to the EU’s goals of reshoring its clean tech industry.

However, they face a significant hurdle: durability. Perovskites degrade when exposed to moisture, light and heat. To address this, researchers are exploring so-called ‘tandem solar cells.’ These combine an ultrathin perovskite cell on top of a regular silicon cell, offering a promising solution for achieving increased efficiency without sacrificing durability. So far, tandem cells have reached a solar conversion efficiency of 33%, with potential to peak at 40%, which could further revolutionise the industry (10).

Next-gen geothermal

Despite being one of the oldest renewable sources, geothermal energy’s availability has been limited by geography. Traditional plants rely on natural geothermal reservoirs, which are mostly concentrated in volcanic regions. As a result, geothermal power plants generated only 0.2 % of the EU’s electricity in 2022 (11). However, innovations like enhanced geothermal systems (EGS) can create artificial geothermal reservoirs, unlocking significant amounts of power potentially trapped beneath the earth’s surface.

Next-generation geothermal technologies offer three key advantages for the EU’s energy and climate goals. First, they could provide a reliable, clean energy source that complements wind and solar. Unlike these weather-dependent renewables, geothermal plants can provide a steady baseload source of energy, reducing the need for energy storage and easing the strain on power grids. Second, they could enhance energy security. Unlike wind or solar, next-generation geothermal systems do not require critical materials, rare earths or rely on Chinese supply chains (12). They often use off-the-shelf equipment from the oil and gas industry, while many of the innovative solutions come from the United States. Third, they can improve energy resilience. Taking up much less space than other renewables, they can be deployed in off-grid areas, near strategic sites or power-hungry industries.

Next-generation geothermal systems come with some unknowns. While pilot projects are well underway to test their feasibility, more investments are required to drive down the costs of these systems (13). The scientific community is also divided about the extent to which some of these technologies could result in greater seismic activity (14). Therefore, despite the technology’s promise, further research and testing are needed to determine the role it could play in the EU’s energy transition efforts.

Advanced biofuels

Biofuels such as bioethanol and biodiesel have long been a staple of the EU’s energy mix. Produced using conventional feedstocks like rapeseed and sugar beets, they have contributed to reducing the GHG emissions of the transportation sector. However, advanced biofuels represent a promising new class of renewable fuels. Produced from non-food sources like agricultural waste and forest residues through innovative processing techniques, these advanced biofuels could boost the EU’s decarbonisation efforts.

Data: IEA, 2024

To some, doubling down on biofuels might seem like a step backward. While electrification offers a clear path for decarbonising ground transportation, shipping and aviation present a much tougher challenge. According to the International Energy Agency (IEA), due to the complex and energy-intensive production process, e-fuels such as e-ammonia and e-kerosene – which are floated as solutions for shipping and aviation decarbonisation – are expected to remain costly and scarce for a long time to come (15). This is where advanced biofuels come into play. They promise lower production costs and greater availability, allowing them to play a crucial role alongside e-fuels in reducing the GHG footprint of shipping and aviation. Advanced biofuels, like e-fuels, can also be chemically identical to conventional oil-based fuels, meaning existing airplanes and ships can use them without requiring engine modifications (16). Unlike conventional biofuels, they also avoid competition with food and feed production, allowing for more sustainable land use.

Scaling up advanced biofuels presents its own obstacles. Production costs need to decrease for them to become competitive with alternative fuels (17). Major infrastructure development is required to handle the large quantities of biomass needed for production, while sufficient feedstock availability must be ensured (18). Yet, despite these roadblocks, advanced biofuels are uniquely positioned to play a key role in reducing the EU’s GHG emissions and dependence on fossil fuels.

Sodium-ion batteries

Lithium-ion batteries play a key role in the energy transition as they are used in electric vehicles (EVs) and energy storage systems. They rely on lithium as the key component and often require additional critical minerals like cobalt, graphite and nickel. However, sodium-ion batteries, using sodium instead of lithium, are gaining traction as a promising alternative.

There are three distinct advantages to using sodium-ion batteries. First, they can significantly reduce the EU’s dependence on critical minerals. Unlike lithium, sodium – or salt – is a thousand times more abundant than lithium (19). Sodium-ion batteries also do not require cobalt, graphite and nickel for their anodes and cathodes, thereby further reducing the EU’s reliance on foreign suppliers. Second, they are cheaper to produce. According to McKinsey, sodium-ion batteries have the potential to be about 20% less costly than the cheapest type of lithium-ion batteries (20). Third, they are more sustainable. Sodium mining and processing have a lower negative impact on the environment compared to lithium, and, by some estimates, they are also easier to recycle (21).

Despite these and other advantages, sodium-ion batteries cannot replace lithium-ion batteries. Because sodium molecules are heavier and larger than lithium, sodium-ion batteries have lower power densities and can store less energy than lithium-ion ones. High-end lithium-ion batteries have a power density of some 250 Wh/ kg, whereas sodium-ion batteries deliver 160-180 Wh/kg, limiting their utility in high-performance EVs (22). Still, in the coming years sodium-ion batteries could be a real game-changer for applications where power density is less crucial, such as compact EVs and energy storage systems.

Making innovation happen

To achieve its climate and energy goals, the EU needs to double down on its innovation efforts. Perovskite solar cells, advanced biofuels, sodium-ion batteries, and next-generation geothermal are but a few of the many technologies that could help accomplish that.

Granted, investments in these and other emerging technologies do not guarantee success. Not all promising technologies live up to expectations, and competition from other manufacturers is fierce. However, history shows that breakthroughs rarely come from playing it safe. Fortunately, the EU is well-positioned to be a clean tech powerhouse. It boasts top-notch research infrastructure, a strong start-up scene, and is home to some of the boldest GHG reduction policies in the world. Three steps could allow the EU to accelerate clean tech innovation even further.

- First, speed up the lab-to-market transition. Brussels needs to ramp up support for the commercialisation of clean technologies by providing funding and resources to bridge the gap between research and market deployment. Focusing on scaling up successful pilot projects and facilitating industry partnerships can bring innovations to the market more quickly.

- Second, mobilise institutional funding. The EU should encourage large institutional investors, such as pension funds and insurance companies, to allocate a greater share of their portfolios to clean technology ventures. This can provide substantial capital flows needed to accelerate the development of capital-intensive innovations.

- Finally, foster international collaboration. Partnerships with like-minded countries such as the United States, Japan and South Korea, could go a long way towards advancing the EU’s goal of promoting broader GHG reduction efforts. Building a broad coalition – ranging from emerging startups and seasoned investors to research institutions and international bodies – is key to success.

The EU’s ability to advance its energy and climate goals without exacerbating dependencies on dominant suppliers hinges on its ability to embrace innovation. By focusing on technologies that play to its strengths, forging strategic public-private partnerships and collaborating with international partners, the EU can lead the way towards a cleaner tomorrow.

References

1. European Commission, ‘Special Address by President von der Leyen at the World Economic Forum’, 17 January 2023 (ec.europa.eu/commission/ presscorner/detail/ en/speech_23_232).

2. Di Sario, F. and Leali, G., ‘Starting from behind: EU vies to gain ground in green tech race’, Politico, 21 November 2023 (politico.eu/article/net-zero-industry-act-clean-technology-climate-change-european- union/).

3. Abnett, K. and Chestney, N., ‘With solar industry in crisis, Europe in a bind over Chinese imports’, Reuters, 6 February 2024 (reuters.com/ business/energy/with-solar-industry-crisis-europe-bind-over-chinese- imports-2024-02-06/).

4. ‘Stable, cheap, efficient perovskite cells – can the ANU find the holy grail of solar?’, ARENA, 15 January 2018 (arena.gov.au/blog/stable-cheap- efficient-perovskite-cells/).

5. Cao, F., et al., ‘Perovskite solar cells with high-efficiency exceeding 25%: A review’, Energy Materials and Devices, Vol.2, No 1, 4 February 2024 (sciopen.com/article/10.26599/EMD.2024.9370018).

6. Lombardo, T., ‘Perovskite solar cells are greener than Silicon’, Engineering.com, 18 August 2020 (engineering.com/story/perovskite- solar-cells-are-greener-than-silicon).

7. United States Department of Energy, ‘Perovskite Solar Cells’ (energy.gov/ eere/solar/perovskite-solar-cells).

8. ‘With solar industry in crisis, Europe in a bind over Chinese imports’, op.cit.

9. ‘China to hold over 80% of global solar manufacturing capacity from 2023-26’, Wood Mackenzie, 7 November 2023 (woodmac.com/press- releases/china-dominance-on-global-solar-supply-chain/).

10. WEF, ‘How tandem solar cells can speed the energy transition’, 15 January 2024 (weforum.org/agenda/2024/01/tandem-solar-cells- energy-transition/).

11. Dulian, M., ‘Geothermal energy in the EU’, Briefing, European Parliament, 2023 (europarl.europa.eu/RegData/etudes/ BRIE/2023/754566/EPRS_BRI(2023)754566_EN.pdf).

12. ‘In America climate hawks and Big Oil alike cheer geothermal energy’, The Economist, 14 March 2023 (economist.com/united-states/2023/03/14/ in-america-climate-hawks-and-big-oil-alike-cheer-geothermal- energy).

13. Matthews, D., ‘Is the future of energy ... pouring water on hot rocks in the ground?’, Vox, 13 September 2023 (vox.com/future-perfect/23825844/ geothermal-enhanced-fervo-demonstration-superhot).

14. Ciucci, M., ‘Innovative technologies in the development of geothermal energy in Europe’, Briefing, European Parliament, 1 December 2023 (europarl.europa.eu/RegData/etudes/BRIE/2023/754200/IPOL_ BRI(2023)754200_EN.pdf).

15. IEA, ‘The role of e-fuels in decarbonising transport’, December 2023 (iea. org/reports/the-role-of-e-fuels-in-decarbonising-transport).

16. ‘Advanced Biofuels – Potential for Cost Reduction’, IEA Bioenergy, February 2020 (ieabioenergy.com/blog/publications/new-publication- advanced-biofuels-potential-for-cost-reduction/).

17. Ibid.

18. IRENA, ‘Advanced biofuels: What holds them back?’, November 2019 (irena.org/publications/2019/Nov/Advanced-biofuels-What-holds-them- back).

19. Tang J. et. al., ‘Advancement in sodium-ion rechargeable batteries’, Current Opinion in Chemical Engineering, Vol.9, August 2015 (sciencedirect. com/science/article/abs/pii/S2211339815000556).

20. ‘Enabling renewable energy with battery energy storage systems’, McKinsey, 2 August 2023 (mckinsey.com/industries/automotive-and- assembly/our-insights/enabling-renewable-energy-with-battery- energy-storage-systems).

21. Wickerts, S. et.al., ‘Prospective life cycle assessment of sodium-ion batteries made from abundant elements’, Journal of Industrial Ecology, 13 November 2023 (onlinelibrary.wiley.com/doi/10.1111/jiec.13452).

22. ‘BriefCASE: Sodium-ion batteries to unseat lithium? Na, but they’ll be worth their salt’, S&P Global, 20 March 2024 (spglobal.com/mobility/en/ research-analysis/briefcase-sodium-ion-batteries-to-unseat-lithium. html).