Green hydrogen has become one of the most hyped technologies of this decade, touted globally as a magic wand for near instantaneous decarbonisation. The media sometimes refer to it as a ‘miracle gas’ given its capacity to clean up transportation, heavy industries, heating, and everything in between (1). Meanwhile, in the EU and elsewhere, green hydrogen has also been increasingly seen as an instrument of diplomacy. Former EU Commissioner for the European Green Deal, Frans Timmermans, once quipped that ‘hydrogen is about to change the geopolitics of energy’ (2).

However, myths and misconceptions often cloud conversations about green hydrogen’s role in the energy transition, fostering unrealistic expectations and setting the stage for eventual disappointment and frustration. To build successful green hydrogen partnerships, a realistic approach is essential, starting with a firm grasp of the fundamentals of how we produce, transport and consume this fuel.

Understanding the basics

Despite being the most abundant element in the universe, hydrogen is not freely available. On earth, it mostly exists in molecules bound to other elements, requiring extraction at a significant energy cost. Currently, around 99 % of the hydrogen produced worldwide is so-called grey hydrogen, which is produced from natural gas and responsible for large amounts of CO2 as a by-product (3). In 2022, hydrogen production accounted for more than 900 million tonnes (Mt) of CO2 emissions (4), more than the total of the global aviation industry (5).

In contrast, green hydrogen, which today accounts for only 0.1 % of all hydrogen produced worldwide, is made by using renewable power and a device called an electrolyser (6). Notably, around 20-30 % of the energy used in the electrolysis process is lost (7). Because this electricity comes from renewables, green hydrogen is considered a carbon-neutral energy carrier.

There is little doubt that green hydrogen will become cheaper and more widespread, but it is difficult to estimate by how much and to what extent. According to an International Energy Agency (IEA) report published in January 2024, companies around the globe had announced more than 360 gigawatts (GW) of green hydrogen projects with start dates before 2030 – but only 3 % of them had reached financial closure or started construction (8). Limited appetite from buyers and high costs have led to slow progress on many projects.

In late 2023, European green hydrogen production costs stood at around €6.2/kg (9). By contrast, grey hydrogen cost around €2/kg (10). As recently as a few years ago, many forecasts assumed that green hydrogen production costs would fall to around €3/kg by 2030. However, a changing macroeconomic outlook and higher electricity prices (electricity accounts for 80 % of green hydrogen costs) indicate that the price of green hydrogen in some European regions is unlikely to fall below €5/kg by the end of this decade (11).

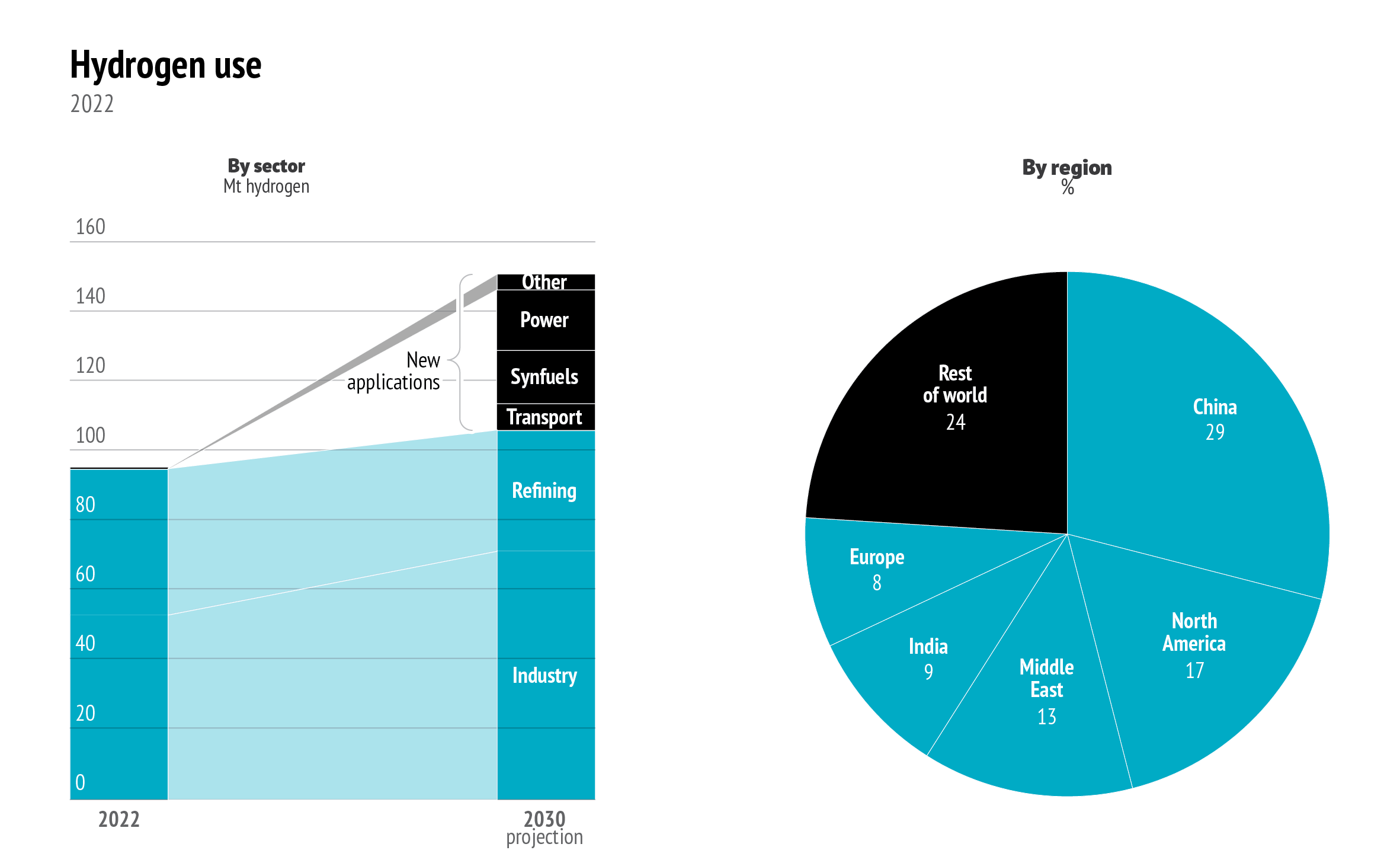

In 2022, global hydrogen demand stood at 95 Mt (12). More than 90 % of the world’s hydrogen is used for just three industrial applications: oil refining; production of methanol used by fuel blenders; and the manufacture of ammonia for fertilisers and chemicals (13).

In principle, hydrogen can be used for a variety of other applications. It can power cars, trucks, balance electricity grids, store energy and keep homes warm, among many other uses. However, other technologies such as electrification using renewables or biofuels pose stiff competition across most of these applications, offering cheaper and more efficient alternatives to hydrogen. For instance, heat pumps offer nearly six times greater energy efficiency compared to heating with green hydrogen (14).

Yet, that does not mean that green hydrogen has no role in the energy transition. Given the scarcity and the high cost of this fuel, in the short term, green hydrogen has the greatest decarbonisation potential in sectors using grey hydrogen. Alternatively, in hard-to-abate sectors like steel and cement where electrification is challenging, hydrogen could replace coal and natural gas. Meanwhile, in the long term, hydrogen derivatives such as synfuels could play a key role in cleaning up the aviation or shipping sectors.

The EU and green hydrogen

The EU views green hydrogen as a key part of its decarbonisation strategy. In 2020, an EU hydrogen strategy was launched with the aim to produce up to 10 Mt of green hydrogen by 2030 (15). Two years later, the REPowerEU Plan introduced the additional objective of importing 10 Mt of green hydrogen by 2030, effectively doubling the EU’s existing target (16). These initiatives are intended to support the European Green Deal goals of reducing greenhouse gas emissions by a minimum of 55 % by 2030 and reaching net-zero emissions by 2050 (17).

To accelerate the creation of a hydrogen industry, the EU has also launched initiatives such as the Clean Hydrogen Partnership and the European Clean Hydrogen Alliance (18). In 2023, the EU also launched its Hydrogen Bank, offering financial support to green hydrogen projects (19). In the same year, the EU also passed the Net-Zero Industry Act, aiming to scale up the production of clean energy technologies, including electrolysers (20). Meanwhile, heavyweights like Germany have recently earmarked 3.5 billion for future green hydrogen imports (21).

The EU’s emphasis on green hydrogen is also reflected in its External Energy Strategy. Approved in 2022, the strategy calls for concluding partnerships to ‘facilitate the import of 10 million tonnes of hydrogen’ (22). So far, the EU has signed partnerships that involve hydrogen with Namibia, Morocco and Egypt, among others. These initiatives aim not only to support bilateral hydrogen trade, but also to accelerate economic growth and decarbonisation.

The EU faces a reality check in its green hydrogen ambitions.

Europe is known not only for its decarbonisation ambitions, but also for a robust green hydrogen industry. It is home to large industrial actors such as Thyssenkrupp, Siemens and many smaller manufacturers like Sunfire and Everfuel. According to the IEA, Europe accounted for around a fifth of the world’s electrolyser capacity in 2023 (23). This share might increase to around a third by 2030, assuming all announced projects come to fruition (24).

Despite these efforts, the EU faces a reality check in its green hydrogen ambitions. According to Hydrogen Europe, demand for green hydrogen is on track to hit 8.5 Mt by 2030, far below the EU’s target of 20 Mt (25). Unrealistically high goals set by Brussels, coupled with high production costs and a lack of renewable electricity, are the main reasons for this gap.

Overall, in less than 4 years the EU has introduced a series of policy initiatives that would firmly place green hydrogen at the centre of its drive to net-zero, sending a clear signal to markets and international partners about the direction in which Brussels is heading. However, given the low uptake of this fuel, the jury is still out as to whether the EU’s bold vision will be implemented.

Making hydrogen partnerships work

Signing partnership agreements with foreign governments is one thing, but inking hydrogen deals is more complicated. This is partly because of the high cost of green hydrogen, but also because transporting hydrogen is challenging.

Transporting large quantities of hydrogen over long distances to Europe by ship will be expensive and inefficient compared to commodities like liquefied natural gas (LNG). There are three reasons for this.

First, hydrogen possesses a fairly low volumetric density. This means that, even when liquefied and superchilled to -253 °C, about 2.4 hydrogen ships would be required to deliver the same amount of energy as a single LNG ship (26). Second, liquefying hydrogen is a very energy-intensive process, consuming around 30 % of hydrogen’s energy content (27). Third, hydrogen storage is complicated. Even if kept in a thermally insulated tank, liquid hydrogen loses 1 % of its content per day due to boil-off, resulting in potentially massive energy losses during ship voyages, or long periods of storage (28).

Therefore, it is not surprising that bodies like the International Renewable Energy Agency (IRENA), among others, have concluded that in the coming decades liquid hydrogen will only have a niche role in global trade (29). Lower energy losses make it more likely that hydrogen will be transported either by pipeline or not at all. To keep costs low, it should ideally be produced close to the point of end-use.

Does this mean that there is no future for the EU and global green hydrogen partnerships? Not at all.

When it comes to trade, green hydrogen derivatives like synfuels offer real opportunities for future collaboration. E-ammonia can be used as a feedstock or as a fuel, while e-methanol and e-kerosene could clean up the shipping and aviation industries. Due to their chemical structure, these substances do not encounter the same transportation or storage hurdles as liquid hydrogen, thus opening doors for long-distance trading.

Beyond trade, the EU could pursue meaningful international partnerships across the entire hydrogen economy. Collaboration is possible in areas such as the deployment of electrolysers, handling of hydrogen and the co-creation of viable business models across the green hydrogen value chain. Promoting the transition from grey to green hydrogen in countries with strong oil refining and ammonia industries can also drive progress towards the decarbonisation of these sectors.

In the long run, the EU could also consider relocating or expanding some of its heavy industry facilities to countries rich in renewable energy resources. This would facilitate the cost-effective production of green hydrogen and the subsequent shipment of finished products, such as aluminium or iron, eliminating the need to transport hydrogen itself. After all, the cheapest way to transport energy may be in the form of materials and products.

Moreover, the EU’s recent Carbon Border Adjustment Mechanism (CBAM), can also be a boon for green hydrogen partnerships. To avoid carbon levies, the EU could encourage countries exporting CO2-intensive goods to adopt green hydrogen to replace coal or natural gas in some industrial applications. After all, the goal is not to curb imports, but to help reduce CO2 emissions by encouraging non-EU manufacturers to ‘green’ their production processes.

Conclusion

Historically, there has been no shortage of misconceptions and inflated expectations about green hydrogen. This is understandable, as most innovations are greeted with a certain amount of hype. However, as we move past the hype, it is time to ‘get real’ about this fuel. Put plainly, today green hydrogen remains an expensive resource, which, in the foreseeable future at least, will only find use in areas where there are no cheaper, safer or more convenient alternatives.

However, this does not diminish the EU’s potential to champion its development. The bloc has strong policies in place and has an established industrial base, two vital ingredients for success. Moreover, the EU can foster international partnerships through investments, best practices exchanges and common projects across the green hydrogen value chain.

A successful hydrogen diplomacy policy requires a clearsighted understanding of this fuel’s technological and commercial realities, both present and future. Crucially, any such policy should direct resources towards hard-to-abate sectors where better alternatives do not yet exist. Failure to do so could not only undermine the EU’s goal of supporting the energy transition worldwide, but also disappoint its partners by overpromising and underdelivering on the results.

References

(1) ‘Hydrogen as a Magic Cure’, ZDF, 25 April 2021 (shorturl.at/gxEJX).

(2) European Commission, ‘Keynote speech EVP Timmermans at EU Hydrogen Week 2022’, 25 October 2022 (shorturl.at/eikoZ).

(3) IEA, ‘Global Hydrogen Review’, September 2023 (shorturl.at/cfk47).

(4) Ibid.

(5) IEA, ‘Aviation’, July 2023 (shorturl.at/lntvx).

(6) IEA, ‘Global Hydrogen Review’, op.cit.

(7) Jackson, J., ‘Energy efficiency improvements needed for green hydrogen production’, Energy Central, 15 August 2023 (shorturl.at/vCZ68).

(8) IEA, ‘Renewables 2023’, January 2024 (shorturl.at/CDR19).

(9) Burgess, J., Naschert, C. and Garg, V., ‘Commodities 2024: Hydrogen developers hope funding support will unlock financing queue in 2024’, SP Global, 2 January 2024 (shorturl.at/cp136).

(10) Schelling, K., ‘Green hydrogen to undercut gray sibling by end of decade’, BNEF, 9 August 2023 (shorturl.at/iuTY7).

(11) Burchardt, J. et. al., ‘Turning the European green hydrogen dream into reality: A call to action’, Consulting Group, October 2023 (shorturl.at/bEKMQ).

(12) IEA, ‘Global Hydrogen Review’, op.cit.

(13) Maguire, G., ‘How realistic is a hydrogen-powered economy?’, Reuters, 23 March 2023 (shorturl.at/fzEP7).

(14) Williams, L., ‘There’s a cleaner way to heat your home, and it’s not hydrogen’, Bloomberg, 26 February 2023 (shorturl.at/eftzC).

(15) Burgess, J., ‘Hydrogen fever in EU puts 2024 target of 6-GW electrolyzer capacity in reach’, SP Global, 7 July 2021 (shorturl.at/lntQU).

(16) European Commission, ‘Hydrogen’, 2023 (shorturl.at/dgt18).

(17) European Commission, ‘Supporting clean hydrogen’, 2022 (shorturl.at/ezS14).

(18) European Commission, ‘Hydrogen’, op.cit.

(19) Spinachi, S., ‘European hydrogen bank’, EPRS, December 2023 (shorturl.at/cqOUV).

(20) European Commission, ‘The Net-Zero Industry Act: Accelerating the transition to climate neutrality’, 2023 (shorturl.at/djsy0).

(21) ‘Germany earmarks up to $3.8 bln for future green hydrogen imports’, Reuters, 20 February 2024 (shorturl.at/oEJR3).

(22) European Commission, ‘EU external energy engagement in a changing world’, 5 May 2022 (shorturl.at/DEUW2).

(23) IEA, ‘Global Hydrogen Review’, op.cit.

(24) Ibid.

(25) Kurmayer, N., ‘EU’s hydrogen economy struggles to pick up pace’, Euractiv, 7 Sept 2023 (shorturl.at/hBFSW).

(26) Fakhry, R., ‘“Hydrogen-ready” LNG infrastructure: An uncertain way forward‘, NRDC, 14 February 2023 (shorturl.at/vwFMV).

(27) Hunt, J., Montanari, P., et. al., ‘Solid air hydrogen liquefaction, the missing link of the hydrogen economy’, International Journal of Hydrogen Energy, Vol. 48, No 75, 1 September 2023 (shorturl.at/gzAV7).

(28) Yang, M., Hunger, R., et. al., ‘A review of hydrogen storage and transport technologies’, Clean Energy, Vol. 7, No 1, February 2023 (shorturl.at/yHKV8).

(29) IRENA, ‘World Energy Transitions Outlook 2022’, March 2022 (shorturl.at/fotJX).